Periods of market volatility or negative returns often create anxiety for investors and sometimes lead many to hold on to money rather than actively invest. This is reflected in the increasing amount of money that has shifted “to the sidelines.” What is money on the sidelines? Sidelined money refers to funds not actively invested in stocks or bonds, but instead, held in cash or cash-equivalent instruments. The market environment in 2022 may have encouraged this trend, as both stock and bond markets suffered significant declines.

A shift of financial assets into the relative “safe haven” of money market funds began in 2022 and continues today. By late April 2023, investors held a near record level of assets, more than $5 trillion, in money market funds. It exceeds a previous peak for dollars set aside in money market accounts, which occurred in March 2020, during the early days of the COVID-19 pandemic.

“A lot of investors, in essence, got ‘out of the pool’ with some of their investable assets in 2022,” says Rob Haworth, senior investment strategy director at U.S. Bank Wealth Management. “Now they have another decision to make – whether to dive in, or at least, start to tiptoe back into the water.”

What factors and opportunities should investors consider as they seek out ways to put money back to work in the stock and bond markets?

A unique investment environment

It isn’t unusual for investors to become anxious about the markets during difficult periods, similar to 2022. As markets decline, some choose to move money out of longer-term investments like stocks and bonds, or to delay actively investing new dollars and keeping cash on the sidelines that could be otherwise put to work. Unusual circumstances added to the challenges investors faced in 2022, as both stocks and bonds suffered significant declines. Typically, one of those two broad asset classes is expected to hold up well if the other falters, which forms a historical basis of owning a diversified portfolio.

While 2022 was an unusual year, it’s not indicative of longer-term trends. Investors who are serious about achieving important financial goals in their lives such as a secure retirement, are best served by actively investing in assets like stocks and bonds. History shows that over time, these so-called “risk assets” are best positioned to generate returns at a level that outpaces inflation.

Although the stock market began to show signs of recovering in late 2022 and early 2023, a sense of caution continues to pervade the markets. While most investors realize that inevitably, they need to put money back to work in stocks and bonds, among the key questions are when to do it, and how.

The opportunity cost of keeping money on the sidelines

When investors hold cash for too long, it results in an opportunity cost, relative to their goals and their long-term portfolio strategy. “Investors often pull money out of markets after they’ve gone down, then are too hesitant to get back until they’ve already recovered,” says Paul Springmeyer, senior vice president and regional investment director, U.S. Bank Private Wealth Management. “This is the risk of trying to time the market. Too often, investors are late to return and miss a major part of the rebound.”

While nobody can predict the short-term direction of the markets, Springmeyer points out more attractive prospects at the outset of 2023. “With both bond and stock markets somewhat sold off, the opportunity from a pricing perspective is better today than was the case at the start of 2022.”

Haworth notes trying to pick the best times to either be invested or keep money on the sidelines often leads to regret in two ways. “We’re most familiar with regret when we lose money during down markets. That experience often prevents us from putting money back to work, and then missing at least a portion of the market’s recovery, resulting in another form of investor regret – the fear of missing out on market rallies.”

Determining how to put money to work

If your clients have money on the sidelines, a key is trying to find ways to capture the opportunities presented by the markets today while managing the risk of entering back into the markets. As you consider money currently held in cash-equivalent investments, it’s important to separate dollars set aside in an emergency fund from money intended to meet longer-term goals. An oft quoted rule of thumb is for households to have funds equivalent to three-to-six months’ worth of expenses set aside in liquid savings that are easily accessible to meet immediate needs.

However, cash not needed for that purpose can be invested with the goal of generating more attractive, long-term returns. One option Haworth suggests is to put a large chunk of money to work in a diversified stock and bond portfolio all at once, but many investors may be hesitant to plunge back into the market that quickly. “Historically speaking, that strategy tends to work most effectively for investors, but the reality is that many people aren’t comfortable funneling large chunks of money into risk assets at one time.”

For investors looking to take on less immediate risk, Haworth says they can also strategically put money to work in specific types of assets and/or invest the available money over a period of time. This can help address concerns about the risk of loss should the market again experience a notable, near-term downturn.

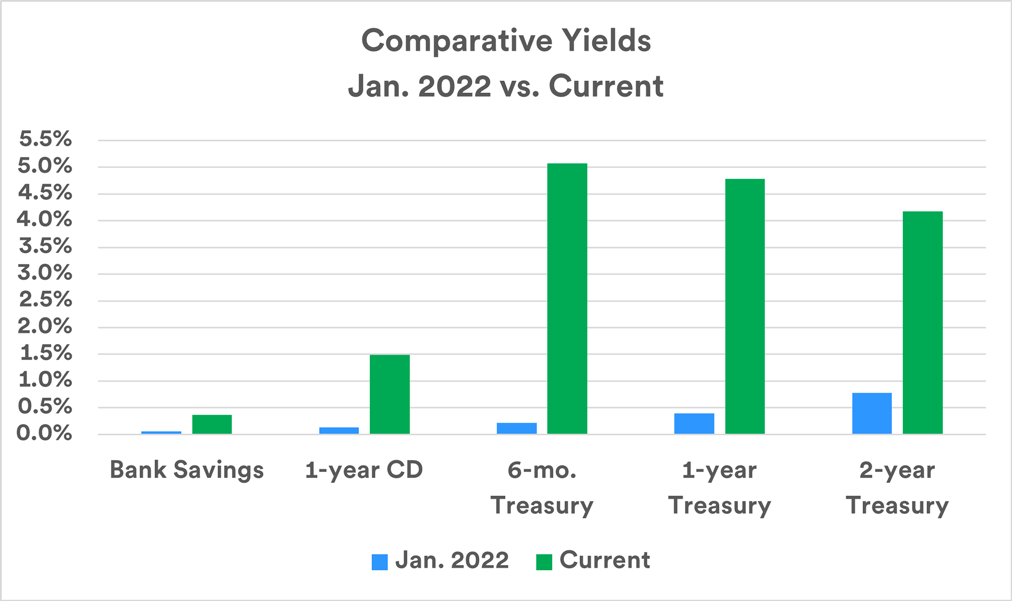

“A first step is to move cash into short-term, lower-quality fixed income instruments that pay more attractive yields given the recent change in the interest rate environment,” says Haworth. Yields on most fixed income securities rose significantly over the course of 2022. He says investment grade corporate debt provides competitive rates, with municipal bonds also offering even more attractive tax-equivalent yields for individuals in higher tax brackets. “It’s important to do the math carefully to see which alternative makes more sense, based on your income level and tax bracket,” says Haworth. Other options to consider are FDIC-insured bank savings accounts, which typically provide immediate liquidity, and certificates of deposit, available for various holding periods. Both vehicles offer more competitive yields than was the case prior to 2022.

Bank Savings based on National Deposit Rates: Savings, as reported by the Federal Deposit Insurance Corporation (FDIC). 1-year CD rates based on National Deposit Rates: 12-month CD as reported by FDIC. Rates for U.S. Treasury securities from U.S. Department of the Treasury, Daily Treasury Par Yield Curve Rates. Current data as of 4/21/23.

He says another logical step to consider with a portion of sidelined assets is to invest in longer-term fixed income securities. Longer-term securities may be less appealing in the current market environment, as yields on shorter-term securities are higher than those on longer-term bonds. This is unusual and a situation that should correct itself over time. Haworth points out that in the municipal bond market, longer-term securities generate a higher yield than those on the short end. That may be an option for investors in higher tax brackets to consider.

Beyond fixed income markets, Haworth suggests directing money back into equities. Assuming the stock market continues to remain volatile, subject to significant moves both higher and lower, dollar-cost averaging can be an effective strategy to help remove some of the risk of investing at the wrong time. “How frequently you make these systematic investments into equities and over what length of time comes down to personal preference and risk tolerance,” says Springmeyer.

How client views on risk affect their approach to cash investing

An important investment consideration is the appropriate level of investor risk tolerance. The answer can potentially change based on recent market experience. Risk may not seem as apparent during periods when markets generate strong returns. But after a year like 2022, when investors suffered through a bear market, investors can be more sensitive to risk. That explains, in part, the large amount of money sitting on the sidelines at the start of 2023.

This may be a good time to re-assess your own views about risk tolerance and determine if you want to make adjustments to a client's portfolio. Springmeyer says for many investors, keeping money on the sidelines turns out to be counterproductive. “It’s important to stay invested for the long-term to capture the opportunities that equities and bonds ultimately generate, without having to make decisions about whether the time is right to get into the market.”

Haworth notes that maintaining a consistent, long-term investment strategy is usually the most beneficial approach. But along the way, changes may be appropriate. “It’s important to regularly rebalance a portfolio to reflect how market performance has changed your asset mix and bring it back to the intended allocation based on your risk tolerance,” says Haworth. “Additionally, you can apply tactical guidance to your long-term strategy to adjust for risks that exist in the current environment.” That means moving some money into assets that may be favorably positioned given underlying economic and market factors.

A time to assess opportunities for holding money or investing your cash

Equity and bond markets may continue to face headwinds in the near term, but there also appear to be reasonable opportunities to put cash to work in ways that will help you achieve long-term objectives. There is no single solution for every investor, but you can discover a strategy that’s most appropriate for your clients.

Review your current portfolio with your wealth professional and explore new opportunities to enhance your long-term investment position, by putting your “sidelined” money back to work.