The pandemic has been a catalyst for digital growth across the money transfer sector. Yet it would be wrong to assume that this has caused the end of cash in international payments. Far from it - cash and the network of cash payout locations not only remains critical but has actually been a key enabler supporting the growth of the digital divisions and businesses across the sector.

For the leading incumbents, a transaction initiated digitally and paid out in cash counts as a digital transaction. That means that both their cash capability and investments in digital have helped them adapt their business models and find new paths to growth at the most critical time. And the Fintechs - they just keep on growing. We look at the importance of both digital platforms and cash payout networks as the sector deals with its biggest changes since the rise of smartphones.

To help understand these trends, we bring together perspectives from the CEOs of six leading players in the space. From the big three incumbents, Western Union’s WU -5.4% Hikmet Ersek, MoneyGram’s MGI +19.7% Alex Holmes and Ria’s Shawn Fielder. For the three leading Fintechs; TransferWise’s Kristo Käärmann, Remitly’s Matt Oppenheimer and WorldRemit’s Breon Corcoran. Additionally, we publish some new data on digital revenues as well as new data on the digital versus cash transaction mix for these players - thanks to the combined work of our own FXC Intelligence analyst team and the support of the companies above.

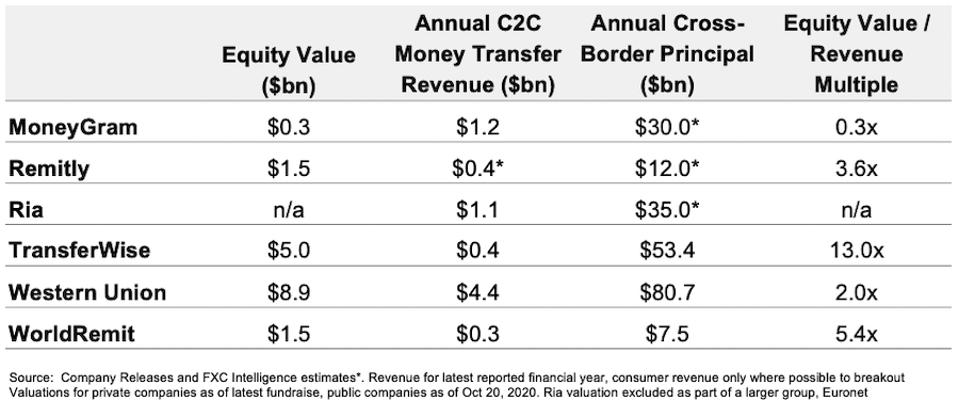

Company Summaries

Digital has stolen the headlines

Over the past five years, Western Union and MoneyGram were managing to steadily grow their digital businesses whilst growth in their overall businesses slowed. However, the pandemic has triggered a rapid shift to digital - which has essentially helped to squeeze four to five years of growth into just a few months.

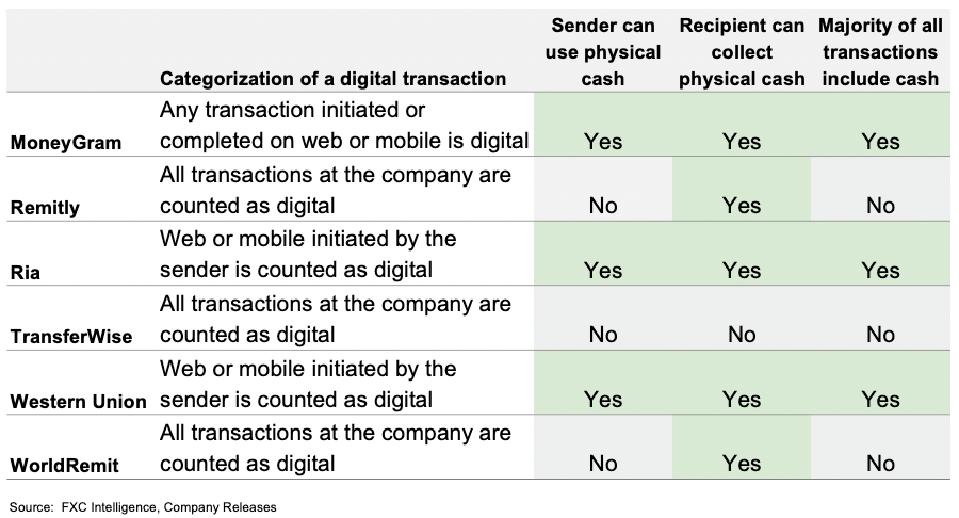

To assess the impact of digital, we have to start with a clear understanding of what digital, cross-border money transfers are. As simple as “digital” sounds, digital means something different depending on which company you are talking about.

The three public companies (Western Union, MoneyGram, and Ria as part of Euronet) have to provide some definitions of digital to the stock market (although these definitions change), but the three private companies have no such requirement.

We are far from comparing apples with apples - think of it more of a mixed fruit bowl.

Table 2: Digital Categorizations

Trying to compare the digital businesses of all these players is therefore not an exact science - nearly all of them categorize different types of transactions in different ways. For the Fintechs, digitally paid-in and digitally paid-out transactions categorize the majority of their transactions. For the leading incumbents, digitally initiated transactions paid in cash make up a much smaller share of their transactions; digitally initiated and digital-paid out (that is to a bank account, card or digital wallet) even smaller still.

The key takeaway from these definitions, before we look at the numbers, is that for all of these players, defining the initiation of the transaction as digital is sufficient to count a transaction as digital. Put another way, digitally initiated transactions, paid out in cash, count as digital transactions. The one exception is TransferWise that offers no cash disbursement option (primarily due to the different requirements of its core expat customer).

Does cash matter then? Much more so than you would ever think.

The importance of cash

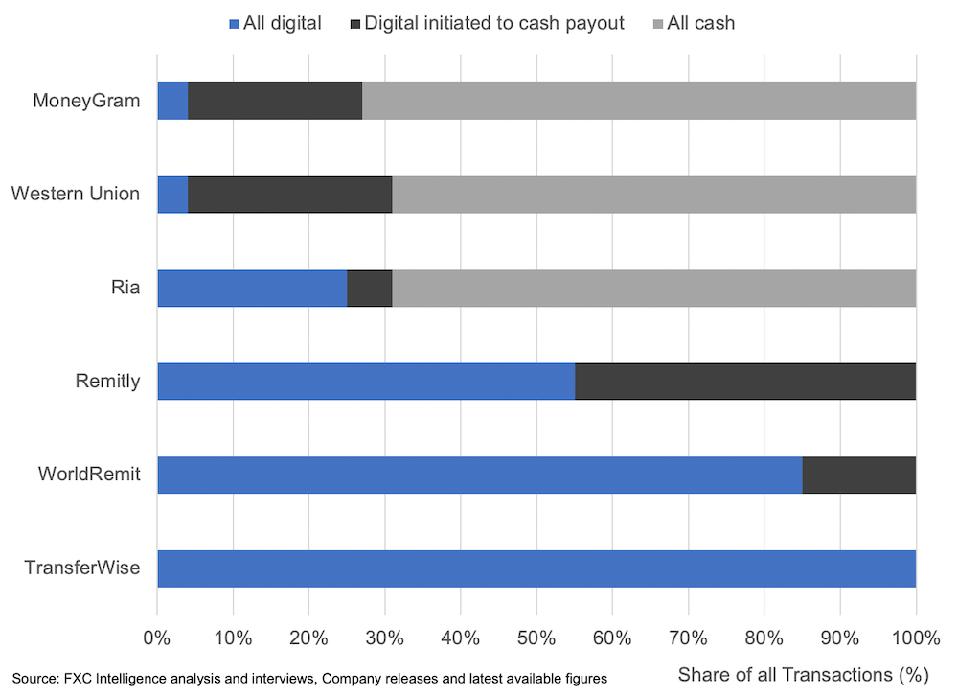

Mix of Transaction Types by Company as of Q2 2020

This chart shows how different these six businesses are. Whether any of these business models is stronger than any other is a different debate.

What is important to note, here, is that the retained importance of cash cannot be understated. Across the five businesses that offer cash, over 80% of combined transactions involve cash. Even for WorldRemit, which has one of the smallest shares of cash payout, Corcoran says “We recognize the importance of cash as a payout option for customers along certain corridors. Our new Transfer Tracker app allows recipients to locate their payments in real time and hugely benefits customers who prefer cash pick up payouts.”

The three Fintechs in the group have been digital first from their inception. Western Union and MoneyGram all started their businesses accepting and delivering physical cash. Ria sits more in the middle. According to Fielder, Ria had to promote bank account deposits as the company was locked out of many of the major cash payout networks such as Post Offices, because exclusive deals were held by Western Union and, to a lesser extent, MoneyGram. Many of those deals are still in place today. 25% of all of Ria’s business is paid out to bank accounts.

It is worth adding that account to account (digital to digital) is the fastest growing segment across the leading incumbents, especially with respect to MoneyGram and Western Union who have been reporting triple digital growth in this segment, albeit from lower bases.

Beyond the persistence of cash, the mix of payouts is changing. Before the pandemic hit, using numbers from the first quarter of 2020, 21% of consumer transactions were digitally initiated at Western Union and 18% at MoneyGram. In the second quarter of 2020, once the impact of the pandemic fully materialized, these shares jumped to 31% and 27% respectively - approximately 50% growth in the digital transactions initiated through the two businesses.

Each of the leading incumbents has invested heavily into their digital businesses, spurred on by the competition from not just these three Fintechs but hundreds more around the world. The pandemic has been the catalyst for the jump of digital penetration rates. The shift away from cash had been accruing but as Remitly’s Oppenheimer puts it, “There had been a gradual shift, and it has been much more exponential since COVID hit, because people either don't feel safe or they just can't get to a physical cash location right now. And so that has resulted in a rapid growth in our business.”

Where are those customers coming from? In the vast majority of cases, still from the cash to cash world. “A lot of the customers, pre-COVID, were still customers coming from an offline world, and so it's not like they're dramatically new or different, it's just that they are joining us at a much faster rate.” explains Oppenheimer. Many are also new customers to the leading incumbents - MoneyGram for example claims that over 70% of its digital customers are new to the brand.

Although an increasing number of customers are moving to the digital world, cash is still playing a key role especially for certain target customers and in certain corridors. According to Western Union’s Ersek, a winning strategy is that digital and physical channels are integrated, so that customers can have a wider choice of payment networks within a single provider.

The value of a cash payout network

Over two thirds of the remittance market is still believed to be picked up in cash (exact market-wide numbers are hard to obtain) and it’s over 80% for the cash enabled providers above. Cash is important on both the pay in (sender) and pay out (recipient) side. Fielder of Ria states it succinctly “Cash still has a bright future because on the payout side, a significant number of people still want to receive their money in cash.” Holmes of MoneyGram agrees, “To say that we would somehow not want to have cash to account capabilities or digital to cash capabilities would be a bit of a mistake...from a capability, long-term growth and cashflow opportunity. I think it's important to leverage both cash and digital.”

Ria has opened up its cash payout network to two of the leading digital players, Remitly, and PayPal’s PYPL -4.9% Xoom. It took Ria 30 years to build the network and Ria believes no new player would even want to try to build out such a network hence providing access to other Fintechs to monetize their network made sense. In Fielder’s words - “Does it invite competition? Sure it does, but the bottom line is that being an aggregator, it changes our long-term focus I think and it diversifies our revenue stream away from just pure family remittance.”

But don’t expect Western Union, who has the leading cash payout network in the sector, to follow suit. As Ersek told us, “As long as it is incremental I will open my platform. As long as it's not incremental, why should I? Why should I cannibalize my existing business? If I open my platform to a competitor to pay out, suddenly they are on the same level with WesternUnion.com.” What Western Union sees as more feasible is to white-label their digital platform to non-competing products as STC Pay in Saudi Arabia and Sberbank in Russia. Although being a small percentage right now, white-labelling capability is a fast growing area and one which provides significant margin opportunities.

It is also important to recognize that there are big differences across different send and receive corridors. “On the receive side, it's still 95 to 97%, cash pickup. We have an account deposit receive service in Mexico, and it's growing extremely fast, but it's tiny in comparison to what you might see in, for example, India or the Philippines or Pakistan or Bangladesh.” describes Holmes. There are even regional differences within this as Ersek explains: “If you look at India, for instance you have a billion people with different economic wealth. If you send money to the Mumbai area or the Chennai area, or in the Delhi area, most of the transactions are going into an account. But if you send to Bihar, most of the transactions are going to be paid out in cash.”

A further difference comes in the type of customer. Within short-term migrant worker communities such as those in the Middle East, a lot of the transactions are sent to self (that is to a bank account owned by the sender in another country). In other corridors with longer-term migrant communities such as the US and sending to Mexico or the Philippines, a lot of the money sent is to someone else, usually a family member and that is often to cash.

Mobile wallets, one of the fastest growing segments of the market, is an interesting exception as none are controlled by any of the leading money transfer players. Africa and parts of Asia have been leading the drive of mobile wallet acceptance, fueled by players such as the telcos in Africa and Alipay and WeChat out of China.

TransferWise highlights a second exception. They have successfully focused much more on the white-collar professional expat who is typically sending money to their own accounts around the world or paying bills such as a mortgage. The average transaction value for TransferWise may be five to ten times that of a typical remittance cash based transaction. At these sizes of transfers, paying out to a bank account makes much more sense.

The Fintechs reach scale

There are four key metrics to describe the sizes of each of these businesses: transaction count, customer count, principal sent (FX flow) and revenue. Over the years, we’ve seen all the businesses above alternating the use of these four metrics. Each business has a bias or benefit to using each of them and none of companies report all of these numbers. Apples to apples? Sadly not - back to our mixed fruit bowl.

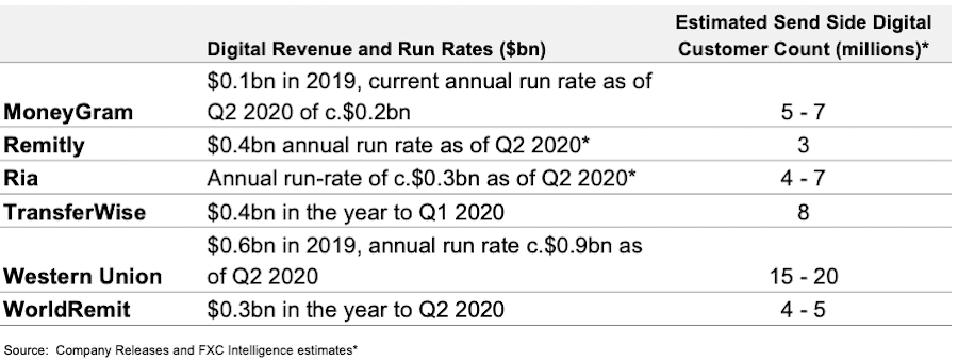

Digital Business Summaries

Overall, Western Union currently retains the leading digital position from a revenue perspective but the Fintechs are fast catching up, doubling or tripling their revenue over the past two years. In terms of total money moved cross-border (FX principal), TransferWise now moves more money for digital transactions than other consumer focused player but its yield per transaction (percentage of revenue earned) is far below the other five players. That means the unit economics also varies substantially amongst these companies, who may have lower average transaction values but earn a much larger percentage of the transaction than TransferWise.

Whether the shift to digital is good or bad for the leading incumbents and whether it's sustainable is a key question. One critical area to help answer this is pricing.

Will pricing pressure destroy the economics of the sector

There has long been a view in the money transfer sector that pricing would have to go to zero. This was driven by a simple perspective that competitive pressures from so many new players entering the market plus the lower cost structures of the Fintechs would drive pricing to rock bottom levels. As some of our own pricing data at FXC Intelligence shows, this simply hasn’t happened. In fact, the pattern is much more complex.

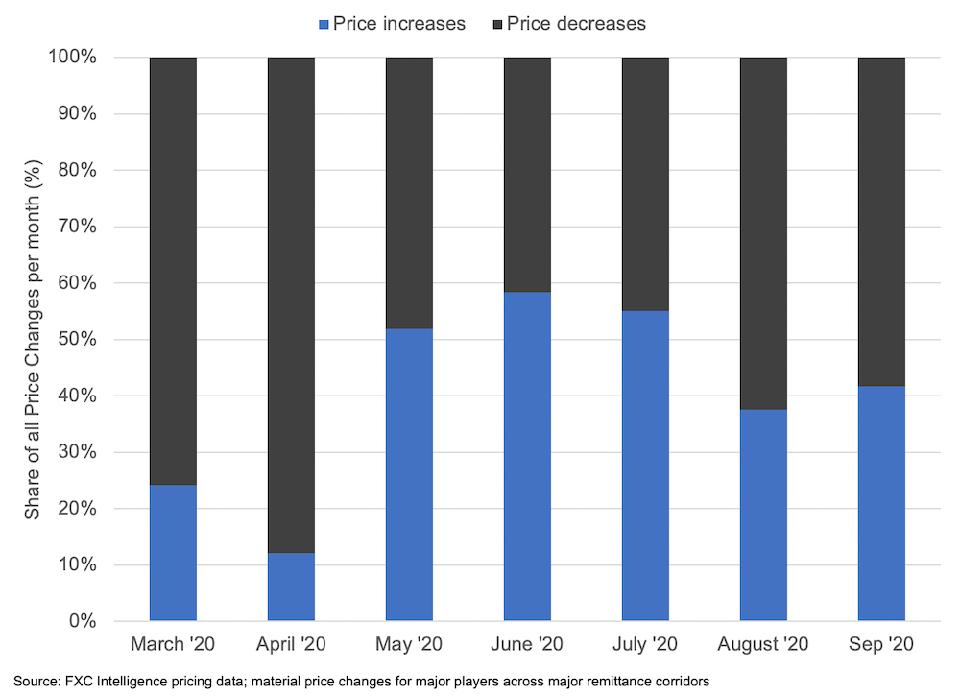

Price Changes across the Sector during the Pandemic

In the chart above, we show significant price changes across the major corridors for the major players through the pandemic. If pricing was going to zero, all we would see is price decreases dominating the chart. Our analysis clearly shows this is not the case and the pattern is more interesting. When the pandemic hit, pricing was reduced. But once the lockdowns eased, pricing was often raised as part of different strategies from May to September.

There are different reasons why pricing has simply not gone to zero. The first is that sending money to many developing markets is much harder and costly than people think. As Ersek, says: “It's not easy to drop money from the US to Morocco. You have to go to all regulatory environments, you have to settle that, you have to get the licenses, you have to report suspicious activities, pay out in the local currency and get the license and have the fraud connection and privacy protection.”

And even though players such as TransferWise have a public mission statement called “Mission Zero” claiming to eventually push the costs of money transfers to zero, their CEO Kristo Käärmann is more realistic regarding the expectation that pricing will reach that level. “It gets very close to zero. I don't know if it's going to get to zero. Probably not really, unless it's subsidized by something else, but it can get very close to zero. And the closer it gets to zero, if someone wants to subsidize it, then that's also going to be a better experience.”

Where next for the money transfer sector?

A number of open questions remain. How will the Fintechs have to adapt their businesses as their scale and prominence grows? For the leading incumbents, how will they continue to respond to the increased competition alongside this switch to digital? Will this fuel more M&A in the space or will most players continue to go it alone for now? For now, all these players have shown great adaptability as they have swiftly increased their digital presence. But it remains to be seen what further challenges the pandemic may present and how each player will respond.

This article originally appeared on Forbes.