(The Motley Fool) - Over the long term, there's no asset class that's consistently delivered for investors quite like the stock market. Even accounting for inevitable down years, the average yearly return for stocks over the very long term has handily outpaced the annualized returns for bonds, gold, oil, housing, and pretty much any other asset class you can think of.

However, it's a completely different story over shorter timelines. The only constant on Wall Street when examined over the course of a few months to a couple of years is inconsistency. Since this decade began, the iconic Dow Jones Industrial Average (DJINDICES: ^DJI), benchmark S&P 500 (SNPINDEX: ^GSPC), and growth-powered Nasdaq Composite (NASDAQINDEX: ^IXIC) have traded off bear and bull markets in successive years.

Although it's impossible to predict directional moves in the Dow Jones, S&P 500, and Nasdaq Composite with 100% accuracy, this doesn't stop professional and everyday investors from trying. Investors will often turn to predictive tools and select economic datapoints that have historically correlated strongly with moves higher or lower in the three major stock indexes.

This predictive tool has been flawless for more than a half-century

Perhaps no predictive tool has been more successful over the long run at forecasting what will happen to the U.S. economy and stock market than the Federal Reserve Bank of New York's recession probability indicator.

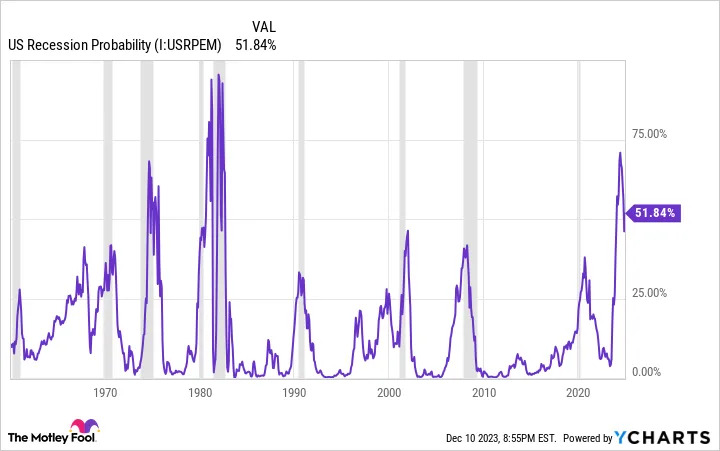

The NY Fed's recession probability tool measures the spread (difference in yield) between 10-year Treasury bonds and three-month Treasury bills to determine how likely it is that a U.S. recession will take shape within the next 12 months.

When the U.S. economy is firing on all cylinders and investors have an optimistic outlook, the Treasury yield curve slopes up and to the right. In other words, longer-dated maturities have higher yields than bills set to mature in mere months. The longer an investor's money is tied up in an interest-bearing security, the higher the yield should be.

What tends to be concerning for Wall Street and investors is when the Treasury yield curve inverts -- i.e., short-term bills sport higher yields than longer-maturing bonds. An inversion tends to be a pretty clear warning that investors anticipate trouble on the horizon.

Here's the interesting thing about yield-curve inversions: Although not every inversion has been followed by a U.S. recession, every recession since the end of World War II has been preceded by a yield-curve inversion. Historically, it's a key ingredient to economic weakness and bear markets.

US Recession Probability data by YCharts. Gray areas denote U.S. recessions.

According to the NY Fed's recession-predicting tool, there's a 51.84% chance of a U.S. recession taking shape by November 2024. Though this is down from a peak probability of more than 70% just a few months ago, it's still a higher reading than at any point over the past four decades.

The magic, yet arbitrary, line-in-the-sand figure for the NY Fed's predictive tool is 32%. Since 1966, anytime the Fed's recession-forecasting model has reached at least a 32% probability of an economic contraction within a year, the U.S. has, without fail, fallen into a recession.

Though this tool has been flawless for the past 57 years, it has been wrong before. In October 1966, there was a greater than 40% chance of a recession that, ultimately, never came to fruition. It's why I noted earlier that there is no such thing as a foolproof predictive tool when it comes to forecasting short-term moves in the Dow, S&P 500, and Nasdaq Composite.

But if history were to rhyme once more, and the U.S. economy does fall into a recession over the course of the next year, it would likely be bad news for stocks. Since the Great Depression, approximately two-thirds of the S&P 500's drawdowns have occurred after, not prior to, an official recession being declared by the National Bureau of Economic Research.

Recessions and bear markets beget opportunity on Wall Street

On the surface, recessions can be scary. They often lead to rising unemployment rates, slow or declining wage growth, and poor performance for the stock market. Although a volatile market can test the resolve and emotions of investors, recessions and bear markets have historically been blessings in disguise for opportunistic investors with a long-term mindset.

The first thing to understand about U.S. recessions is how quickly they pass. In the 78 years since World War II ended, there have been 12 recessions. Nine of these recessions failed to reach the one-year mark, while none of the remaining three surpassed 18 months.

By comparison, most periods of economic expansion have endured for years. In fact, there have been two expansions since the end of World War II that lasted longer than a decade. Long-winded periods of economic growth are what allow corporate earnings to meaningfully expand over time.

What makes Wall Street such an amazing wealth creator is that this disproportionate optimism can also be observed in the major indexes. Despite the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite working their way through dozens of respective corrections since their inceptions, these major indexes have always, eventually, reached new all-time highs.

A June-released dataset from investment analysis company Bespoke Investment Group further confirms the value of being an optimist.

The researchers at Bespoke examined every bull and bear market in the S&P 500 dating back to the start of the Great Depression in September 1929. For its part, Bespoke defined a bull market as a 20% or greater rally following a 20% or greater decline, while a bear market is the reciprocal -- a 20%-plus decline after a 20%-plus rally. A total of 27 separate bull and bear markets were identified in the S&P 500 over the past 94 years.

Over this close to one-century timeline, the average bear market for the S&P 500 has lasted 286 calendar days, which equates to roughly 9.5 months. Comparatively, the average bull market has stuck around for 1,011 calendar days, or approximately two years and nine months.

This dataset unequivocally demonstrates the power of being optimistic and allowing time to work in your favor. If a recession and/or bear market awaits investors in 2024, it should be viewed as an opportunity to buy stakes in high-quality businesses at a discount.

By Sean Williams, The Motley Fool