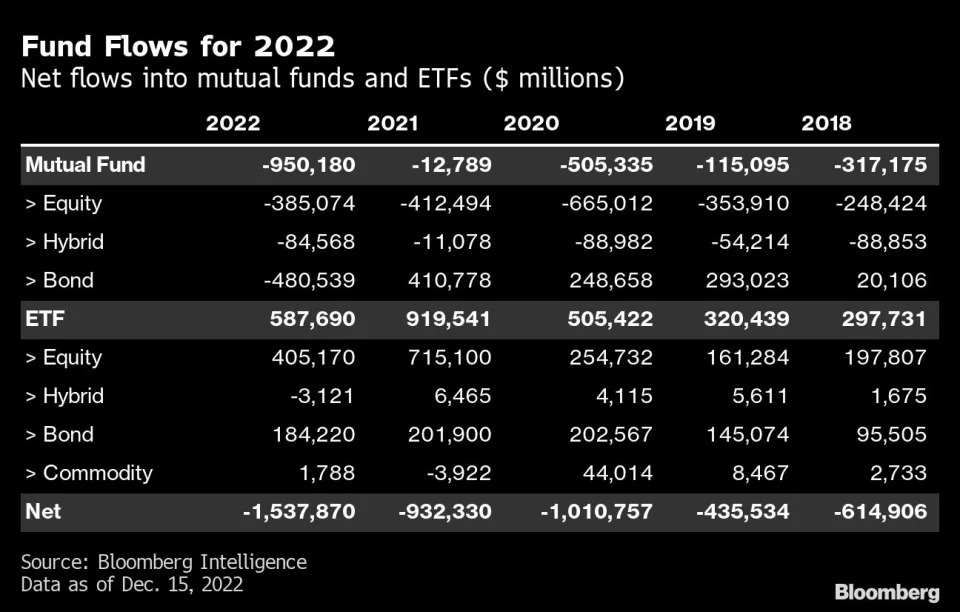

(Bloomberg) - Investors are spurning mutual funds at a record clip, driving a $1.5 trillion gap in the flow of money from the old-school investment vehicles and into ever-popular ETFs.

The divide this year between the two investment types widened to an all-time high, up from $950 billion in 2021, according to data compiled by Bloomberg Intelligence. The growing disparity is one measure of the speed with which ETFs are eating into the market dominance of mutual funds.

The tide has been shifting for years in an embrace of ETFs’ easier-to-trade and tax-friendly structure. But the market turmoil and a fixed-income rout amid aggressive Federal Reserve rate hikes in 2022 further accelerated the divide as investors elected to make faster moving bets in exchange-traded funds over their staid brethren.

“Bonds having their first major bear market in over 40 years has resulted in a colossal industry-altering move from mutual funds to ETFs,” according to Todd Sohn at Strategas Securities.

“It’s been a development really two years in the making, going back to the Fed buying fixed-income ETFs in 2020, and then the rise of inflation and a tighter Fed resulting in a major bear market for bonds,” the ETF strategist said.

Mutual funds saw investors pull $480 billion out of fixed income, the first yearly outflow for the asset class since 2015. At the same time, ETFs have raked in bond investments of $184 billion as of Dec. 15, less than the over $200 billion seen in the prior two years.

The unusual year for stocks and bonds, where both markets tumbled in near total lockstep, has put pressure on money managers to seek hedges elsewhere amid surging inflation and tightening monetary policies that drove yields higher. This may have prompted investors to increase their weight in bonds, according to Sohn.

“There are investors out there who need to re-up their weight to fixed income given the decline and so using ETFs is another route to do that,” Sohn said.

ETFs have been gaining ground across the board, luring in nearly $588 billion so far this year and are on course for their second-best ever annual haul, according to Bloomberg Intelligence data. Meanwhile, mutual funds have seen roughly $950 billion of cash leave the asset class, the biggest outflow on record.

ETF investments now make up about 28% of total US fund assets, up from around 20% five years ago, Bloomberg Intelligence data show.

The chance to lock in mutual fund losses and offset capital gains tax, a practice called tax-loss harvesting, is also helping drive the migration out of mutual funds this year.

“Right now may be an opportune time to move into ETFs offering similar market access without running the risk of facing huge capital gains,” said Cinthia Murphy, director of research at ETF Think Thank. “The numbers would suggest a lot of investors are making this transition out of mutual funds, adopting the typically-lower cost and more tax-efficient ETF wrapper.”

Read more: Exchange-Traded Funds—Attractive Year-End Options?: Tax Insight

Still, the $15 trillion mutual fund universe far outweighs the $6 trillion ETF market. Mutual funds, for one, have been around longer, and taxes on gains for longer-term holders make them harder for investors to switch, said Drew Pettit, director of ETF analysis and strategy at Citi Research. People also stay invested in mutual funds because the more established asset class offers more strategies.

“Not all of the mutual fund strategies that are out there have made their way into ETFs,” Pettit said in an interview at Bloomberg’s New York office. Although, he noted, conversions of existing mutual funds into ETFs are slowly shifting the dynamic.

“We don’t have this huge ground swell of hedge fund-like strategies and ETFs, but more and more of that is coming to market,” he said.

By Isabelle Lee

With assistance from Sam Potter