(MarketWatch) - The Santa Claus rally is off to the best start in over 20 years and historically that bodes well for the entire seasonal period, Dow Jones data show.

Santa Claus is handing out gifts on Wall Street.

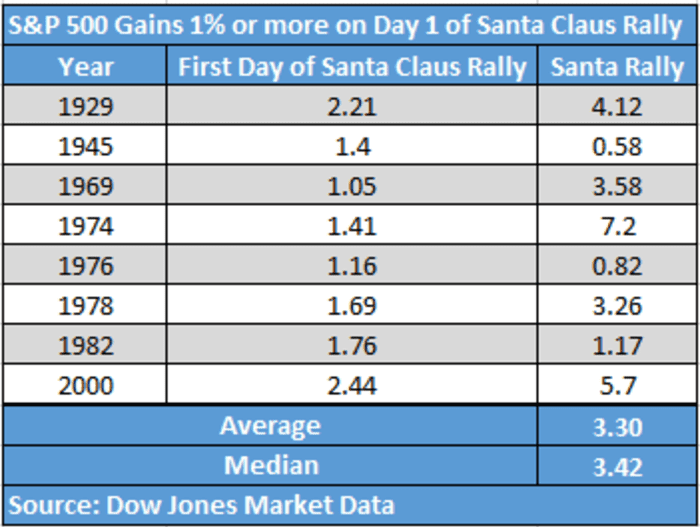

The so-called Santa Claus rally that tends to materialize in the U.S. stock market in the final week of December and the first two trading sessions of the new year, is off to its best start since 2000-01, when the market gained 5.7% over the period, according to Dow Jones Market Data.

At last check, the S&P 500 SPX, 1.37% was trading in record territory, up around 1.1%, with Monday technically marking the start of the seasonal period referred to as a Santa Claus rally; if gains hold up, the stock market tends to perform well, the data show.

The upbeat mood to start the final week of trading in 2021 was helping to lift the Dow Jones Industrial Average DJIA, +0.95% and the Nasdaq Composite Index COMP, +1.38%, with even higher-risk assets such as bitcoin BTCUSD, +0.86% being driven upward to start the week.

By Mark DeCambre