The focus of this proposal is retirees who own their homes but have little or no financial assets. They are said to be “house-rich but cash poor.” As a rough estimate, they number perhaps 15 million. A small change in the Federal tax code would help them at no reduction in Federal tax revenues and would increase in revenues in some states.

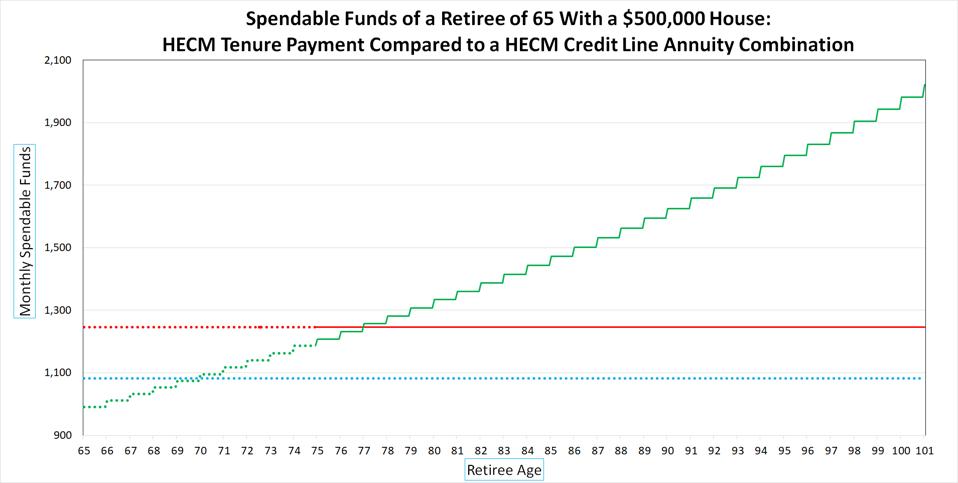

With their wealth largely or entirely in their homes, there is only one way these retirees can convert that wealth into spendable funds that will last a lifetime, while remaining in their homes: taking out a HECM reverse mortgage. For example, a retiree aged 65 who has no financial assets but owns a $500,000 house can take a HECM tenure payment of about $1083 a month for as long as he or she lives in the house.

But there is a better option that is not being used. By taking a HECM credit line and using it to purchase a deferred annuity, a combination of monthly draws from the credit line and annuity payments after the deferment period provide larger payments than a tenure payment over the retiree’s lifetimes.

[Note: The prices used for tenure payments and credit lines are the highest quoted by any of the lenders who report their prices to The Mortgage Professor website, while annuity prices are the best of those with A-ratings or better. Prices are as of February 2, 2021]

Annuity/HECM combo vs HECM tenure payment

www.mtgprofessor.comThe credit line/annuity combination has some other advantages over the tenure payment. Tenure payments cease if the borrower moves out of the house, whereas annuity payments continue for life even if the retiree must move out of their home for health or other reasons.

In addition, the HECM/annuity combination can include a cost-of-living adjustment, which is illustrated in the chart with a 2% increase (green line). The rising payments in future years are made possible by the lower payments in the early years, as well as the mortality determined decline in the number of retirees receiving payments. It is likely, furthermore, that the larger payments on the combo will result in fewer tax delinquencies, which would reduce claims against HUD’s reserve account.

However, insurers today view annuities funded by reverse mortgages as “unsuitable,” and will not accept them. As a result, retirees today can use the credit line/annuity combo only through subterfuge. A determined retiree can place the funds drawn on the credit line into a bank deposit or investment account, then cite this account as the funding source of the annuity. Such cases are very uncommon.

A major reason why insurers view annuities funded by reverse mortgages as “unsuitable,” is that it means a switch from untaxed payments to taxed payments. [Under current Federal tax rules, an annuity purchased with HECM reverse mortgage proceeds would be treated as a “non-qualified” purchase, which means that annuity payments to the retiree in excess of the premium paid would be taxed as ordinary income].

Concerns about suitability would largely disappear if the Federal tax code was modified to eliminate taxes on annuity payments that had been wholly funded with reverse mortgages. In effect, this change in the tax code would provide a Federal sanction to HECM/annuity combinations. There is also precedent for such action: 4 of the 8 states that currently tax annuity payments exempt annuities purchased with funds from IRAs, 401Ks and 403bs.

In light of the monumental issues confronting the Federal Government today, why bother with this one? Because millions of Americans are fast approaching retirement with their wealth largely or entirely in their home equity. Treating HECM-funded annuity payments as tax-exempt could increase the spendable funds available to these hard-pressed retirees at a period in their lives when those dollars count most. There would be no loss in Federal tax revenues because the number of credit line/annuity combinations now being written is negligible. And because the tax emption would result in more annuities being written, there would be an increase in revenues in the 8 states that now tax annuity premiums.

This article originally appeared on Forbes.