(Bloomberg) - Prominent economists Larry Summers and Mohamed El-Erian joined a cohort of their peers in criticizing Fitch Ratings’ decision to downgrade the US given signs of resilience in the world’s largest economy.

Former Treasury Secretary Summers said while there are reasons for concern about the long-run trajectory of the US deficit, the country’s ability to service its debts wasn’t in doubt. El-Erian, chief economic adviser to Allianz SE, said the downgrade was “a strange move” that was unlikely to impact markets.

“The idea that this is creating the risk of a default on US Treasury securities is absurd, and I don’t think that Fitch has any new and useful insights into the situation,” Summers said in an telephone interview. “If anything, the data in the last couple of months has been that the economy is stronger than what people thought, which is good for the creditworthiness of US debt.”

“I can’t imagine any serious credit analyst is going to give this weight,” said Summers, a Harvard University professor and paid contributor to Bloomberg TV.

Economic Shocks

Fitch cut its US rating by one step to AA+ from AAA, saying tax cuts and new spending initiatives along with a number of economic shocks have pushed up budget deficits. The move follows a decision by S&P Global Ratings to downgrade the US from its top-tier in 2011, and leaves Moody’s Investors Service as the only one of the main ratings agencies to keep the nation at its highest level.

“The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades,” Fitch said in a statement.

That erosion in governance “has manifested in repeated debt limit standoffs and last-minute resolutions,” the ratings company said.

Even with the bipartisan agreement to suspend the US debt ceiling reached in early June, there’s been a steady deterioration in standards of governance on fiscal and debt issues over the past 20 years and limited progress in dealing with rising social welfare costs, the Fitch analysts wrote.

The US debt burden will reach 118% of gross domestic product by 2025 — more than two-and-a-half times higher than the ‘AAA’ median of 39%, according to Fitch, which projects the debt-to-GDP ratio will rise even further in the longer-term, increasing America’s vulnerability to future economic shocks.

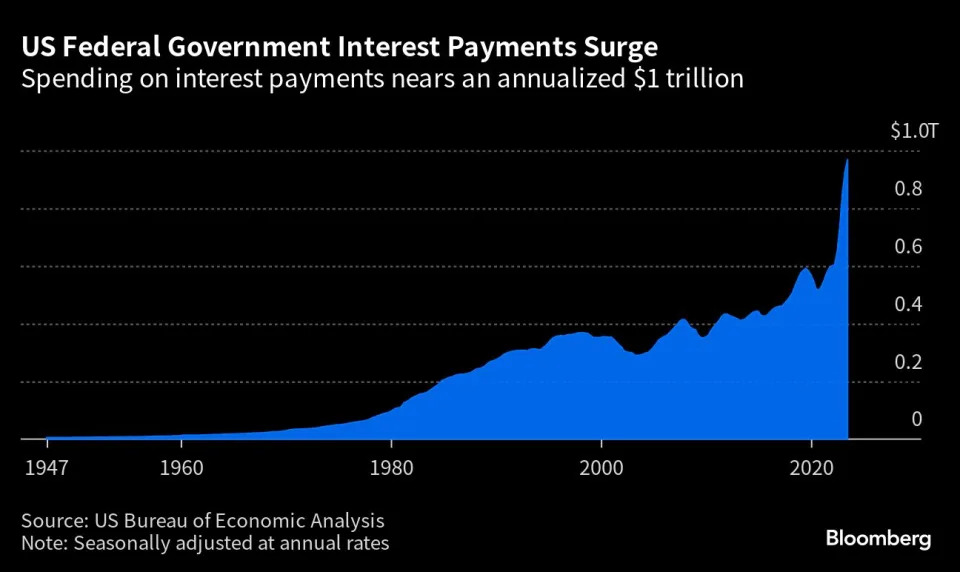

The federal deficit hit $1.39 trillion for the first nine months of the current fiscal year, up some 170% from the same period the year before. That rise was due in part to rising interest rates as the Federal Reserve tightens monetary policy, with the cost of servicing US government debt jumping by 25% to an 11-year high of $652 billion.

On Monday, the Treasury department boosted its forecast for borrowing in the July-through-September quarter to $1 trillion, more than some analysts expected and well above the $733 billion it had predicted in early May.

What Bloomberg Economics Says..

“The decision by ratings agency Fitch to downgrade the US from AAA to AA+, citing a deterioration in governance, concerns regarding social security and Medicare sustainability and a mounting interest expense, isn’t wrong. But two months after the debt ceiling debate has been resolved and with 2Q growth surprising to the upside, the timing is odd, and the Fitch assessment doesn’t tell the markets much they didn’t already know.”

— Stuart Paul and Anna Wong, economists

“The vast majority of economists and market analysts looking at this are likely to be equally perplexed by the reasons cited and the timing,” El-Erian wrote in a post on Twitter, the social media platform being renamed X. “This announcement is much more likely to be dismissed than have a lasting disruptive impact on the US economy and markets.”

The immediate reaction of financial markets in Asia was relatively muted. Treasuries edged higher as the decision counter-intuitively boosted demand for debt issued by the world’s biggest economy as a haven. The dollar rose against most of its major peers, while US stock futures ticked lower.

‘Completely Absurd’

“Fitch downgrades the U.S., a decision widely and correctly ridiculed; it doesn’t make sense even on their own stated criteria,” Noble laureate and New York Times columnist Paul Krugman posted on Twitter. “There’s surely a story behind this — but whatever it is, it’s a story about Fitch, not about U.S. solvency,” he said.

Fitch’s decision was “completely absurd,” said Jason Furman, a professor of economist practice at Harvard University and formerly President Barack Obama’s top economic advisor.

“The United States is so well within the AAA zone that small changes one way or the other in any of these shouldn’t matter,” Furman wrote in a post on Twitter, referring to improvements in Fitch’s own key criteria such as macroeconomic performance and the US debt-to-GDP ratio.

In addressing the criticisms, James McCormack, global head of sovereign and supranational ratings for Fitch Ratings, said the downgrade was based on the medium-term fiscal outlook for the US, “which is characterized by rising deficits and government debt,” rather than predictions of a potential recession, he wrote in an emailed response to questions.

“In our view, US fiscal metrics will compare less favorably with rating peers in the period ahead, and we are not confident in policy measures being agreed and implemented to address the fiscal deterioration,” McCormack wrote.

(Updates with economist comments in the 14th paragraph.)

By Richard Henderson

With assistance from James Mayger and Jill Disis