Old Hollywood worked itself to death to pay alimony and the IRS. New Hollywood racks up billions on blockbusters. Connery played the best hand he could in the middle.

Every generation produces legends. Sean Connery needs no introduction. He came out of nowhere, left an indelible image and called nearly all his own career shots.

When he liked a role, he insisted on rewriting the lines. When he hated a director, he wasn’t shy about pulling out of a project and refunding the money.

That freedom undoubtedly cost him hundreds of millions of dollars in the last few blockbuster-crazed decades. But that’s the way he wanted it.

As a result, his career avoided most of the late-life embarrassments that softened the reputations of many of his peers. His final decades were spent largely in retirement instead of chasing novelty roles.

And as age stole his energy and slowed his wit, he didn’t have to make public appearances. People remember him at the peak of his powers.

Efficient money management made it possible.

“Control what you can”

Every financial planner knows that worrying about what you can’t control is a waste of energy. You need to focus on the things that actually make a difference.

We can’t manage mortality or the market. They’re like the weather. All we can do is check the forecasts and keep an umbrella nearby.

And unless you’re a politician yourself, the amount of income the government will claim is also beyond your control. All you can do is decide where you live. Move if you don’t like the tax regime.

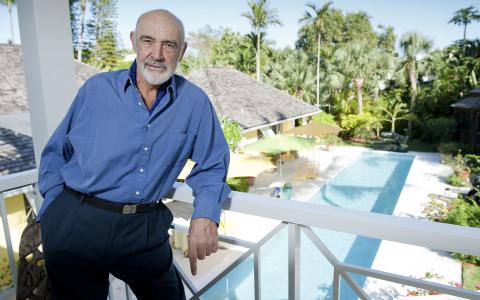

That’s what Connery did when he shifted his official residence to the Bahamas golf cottage in the 1980s. While he wasn’t even thinking about retirement yet, getting out from under the UK’s then-oppressive tax rates stretched every role he took after that.

It wasn’t a question of patriotism. He never renounced his citizenship. It was a matter of math.

Back in the James Bond days, he paid the government as much as 90% of what was then record movie star income. Earn $1 million, keep $100,000. Make two films to support the same lifestyle his U.S. counterparts enjoyed on a movie a year.

Admittedly, rates went down over the decades and he always paid what he was assessed. But it’s still hard to compete with the Bahamas and no income tax at all. Like a generation of British millionaires, Connery found himself a home that wasn’t such a drag.

We see something similar going on today as hedge fund managers pour out of California and New York in search of lower-tax domiciles. Maybe the movie stars will follow.

Of course, those on the blockbuster circuit are incredibly wealthy no matter where they live. A few percentage points off the gross won’t matter much. In Connery’s era, every $1 million mattered.

How much is enough?

He would cheerfully take on “fun” roles for $100,000 a day and donate the proceeds, but that still implies peak earning power around $36 million a year. Doing the math, in the 1990s he rarely did half that much work.

Arnold Schwarzenegger broke that barrier. Now Tom Cruise, Dwayne “The Rock” Johnson, Mark Wahlberg, Ben Affleck . . . the list of action stars who can demand at least $30 million per film goes on and on.

Connery took $17 million for one of his last roles, “League of Extraordinary Gentlemen.” That one didn’t go well, and it marked the beginning of a long era when he effectively withdrew from the cameras, the critics and the checks.

If 90% of that payday went to taxes, he would have worked a lot more on projects he hated. But because he’d already kept more of his income up to that point, he didn’t need to work.

He turned down roles that were too small and roles that were too demanding. He’d already made his money and although it was invested in a few million-dollar villas and condos in the world’s glamour spots, he lived fairly simply.

As long as golf and his wife were nearby, he was happy. There’s a lesson in that as well. I could retire on a $17 million payday because my needs are a long way from Hollywood standard.

I suspect a lot of your clients, even the best ones, operate on a similar scale. And like Connery, I’m unlikely to see that payday cut in half in divorce court.

Alimony kills a lot of retirement plans. Sean Connery married young, split up relatively early and found his second wife 45 years ago.

Since then, there were no splits, no spousal payments and no duplicate households. If staying in the UK would have eliminated 50-90% of Connery’s lifetime earning power, every late-life divorce would cut even deeper.

Think about stars like Mickey Rooney who literally work themselves to death because all the settlements pushed them back to Square One again and again. Think about the terrible projects they participated in late in life because they needed the money.

We can’t control our hearts or even those of our clients, but we can protect them from romantic disaster. Prenuptial agreements and trusts can rescue a lot of retirement plans and ultimately prevent great careers from disaster.

It isn’t cruel or cynical. Like Connery’s choice to leave Scotland for a sunnier and financially friendlier haven, it’s just risk management.

Reading between the lines, Connery gave up most of his post-tax Bond money in the divorce and had to start over. Money for his son went into trust at that time to ensure the estate plan.

His widow inherits his legacy now. The estate might not be huge but she’ll be comfortable. And they got decades together because he wasn’t working all the time. How great is that?