(TheStreet) - Over the weekend, several folks contacted me with questions about the banking sector. The questions revolved around one key point:

Since financial institutions are being bailed out, and because bank stocks have already been hammered, does buying banks now make sense?

I told them to avoid the sector.

Just last week, some investors believed that buying Credit Suisse (CS) at $2 was a low-risk proposition. Those folks are now staring at a loss of about 50% after just a few days.

Despite the current environment, an analyst at R.W. Baird recommended that investors buy U.S. Bancorp (USB) . On a Monday appearance on CNBC's Closing Bell, Baird analyst David George said the following:

"This is not a crisis in my opinion. I just don't believe that Silicon Valley or Signature are really relevant comparisons. It's an incredible opportunity to get more aggressive on these stocks."

I hope those words don't come back to haunt Mr. George. I'm certainly much less sanguine about the current situation for the market in general, and for financial stocks in particular.

There is a saying in this business, "don't catch a falling knife." That's great advice, but in the case of U.S. Bancorp, buyers risk catching a falling piano.

Chart Source: TradeStation

Institutions are dumping this stock with gusto. On Monday, volume was approximately 4x its 50-day average (point A). U.S. Bancorp's volume has been above normal every day since March 9.

USB is well below its 50-day (blue) and 200-day (red) moving averages, which appear ready to cross (point B). This an indication of bearish momentum.

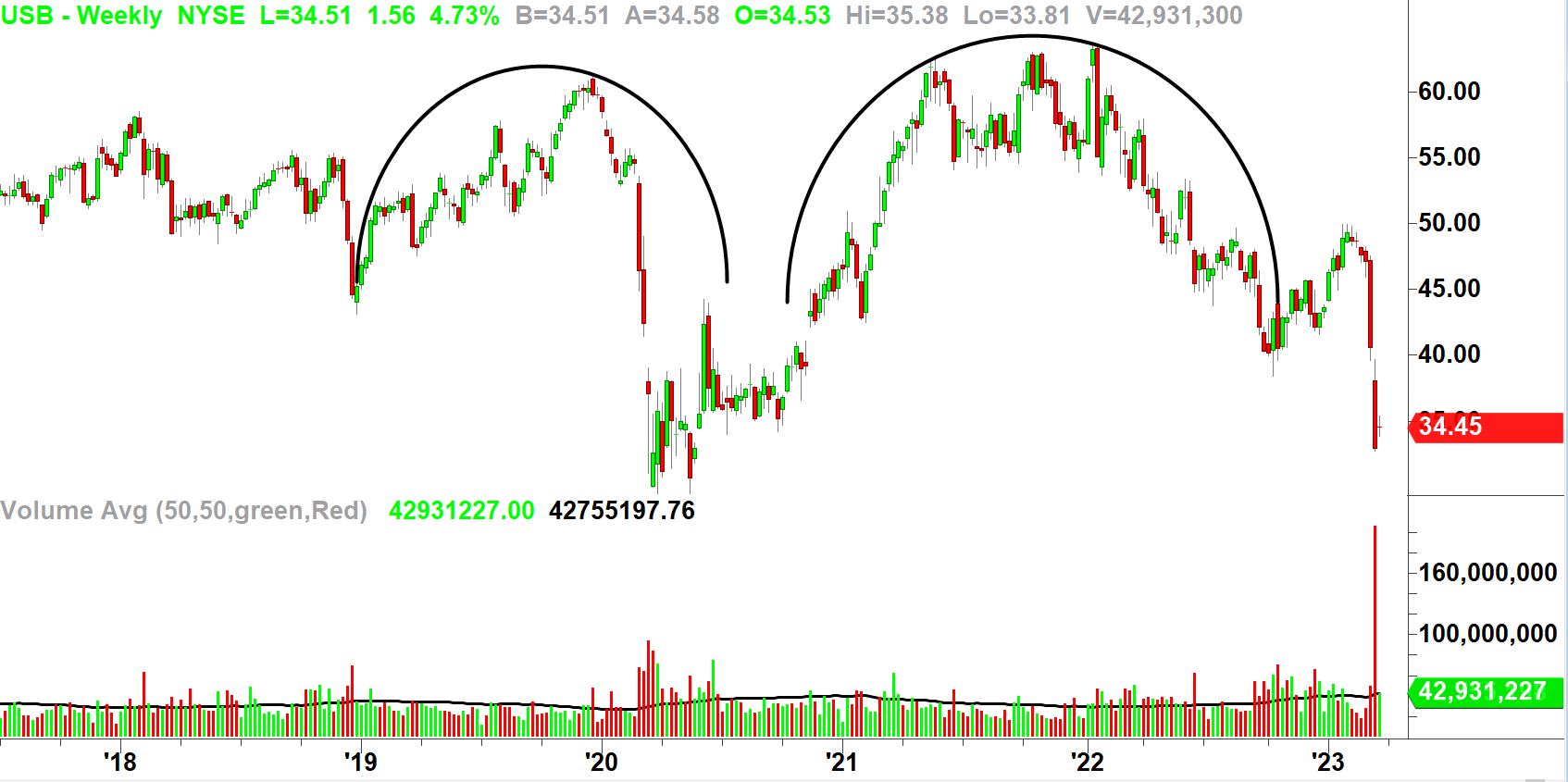

On U.S. Bancorp's weekly chart, a huge double top is visible (curved lines). This massive bearish pattern formed over a four-year period.

Chart Source: TradeStation

Why do investors feel the need to "bottom-fish"? We do it because everyone loves a bargain. It doesn't matter if it's a pair of shoes or a box of cereal, it feels good to buy something for less than its worth.

The problem is, how can we place an accurate value on any individual financial institution when there are potential systemic issues with the entire sector?

If R.W. Baird or any other investment firm believes it's safe to jump in, that's just an opinion. Even if Mr. George's assessment is correct, is the reward really worth the risk?

Until the extent of damage is clear, there's no worthwhile reason to buy U.S. Bancorp or any other names in the financial sector.

By Ed Ponsi

March 21, 2023