(Benzinga) - The latest inflation data didn’t come as much of a surprise to most investors, even though the 8.5% increase in the consumer price index for March was higher than economists predicted.

The added pressure being added to the stock market from this new data is making certain alternative investments even more appealing. This is especially true with alternative investments that are tied to physical assets, which often increase in value with inflation and remain more stable during a market downturn.

Real Estate

Virtually all types of real estate have performed well over time, but inflation concerns make certain segments of this asset class more appealing than others.

Properties with short-term leases typically offer the greatest hedge against inflation since lease rates can be adjusted quickly. While long-term leases often have built-in rent increases tied to inflation, they’re usually capped at 3% annually.

One-year leases are common in multifamily and single-family rentals. This allows the property manager to adjust rents annually to keep up with the market. Self-storage units have even shorter leases, typically month-to-month, giving operators the ability to adjust rents every month if necessary to keep up with rising costs.

Running out to buy a property may not be the most feasible option for most investors right now, but the availability of fractionalized real estate investments is growing.

Investors can buy shares of rental properties for as little as $100, or invest in large-scale multifamily developments in some of the fastest growing cities in the country.

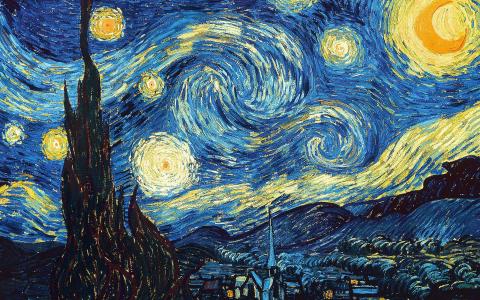

Fine Art

Art has been a popular method of storing wealth for generations, which is no surprise considering that it has outperformed the S&P 500 for the past 25 years and appreciates at an average rate of 23.2% in years where inflation is at least 3%.

This type of investment used to be available only to the ultra-wealthy. However, retail investors now have options to buy shares of valuable works of art.

The global art market has seen incredible growth lately, with total auction turnover hitting an all-time high in 2021. This is largely due to the growing number of investors entering the market in search of reliable alternative investments.

Farmland

The United States is losing farmland at a rate of over 1 million acres per year, while the global demand for food is steadily rising. One cost increasing the most is food, mainly that made with wheat and corn.

Going by the laws of supply and demand, the likelihood of farmland seeing significant increases in value seems high.

Farmland has produced positive returns each year since 1991, with low volatility compared to other major asset classes and little correlation with the stock market.

Find the latest news, data and offerings on Benzinga Alternative Investments.

By Kevin Vandenboss