Keep calm and stay long Apple. Even after the company revealed the fallout in China from the coronavirus is going to prevent it from meeting revenue guidance for the March quarter.

This isn’t about being blindly bullish on the world’s most valuable company. Rather, it’s about keeping the announcement in proper perspective.

It’s Not All About the Economy, Stupid

It’s about short-term supply, not long-term demand. Per Apple’s official press release:

The first is that worldwide iPhone supply will be temporarily constrained. While our iPhone manufacturing partner sites are located outside the Hubei province — and while all of these facilities have reopened — they are ramping up more slowly than we had anticipated... These iPhone supply shortages will temporarily affect revenues worldwide.

Put simply, sales won’t be lost, they’ll shift out a quarter or two. Any March quarter downside becomes June and September quarter upside.

After all, as Evercore analyst Amit Daryanani noted, “It is unlikely that customers seeking AAPL product will go out and buy non-AAPL products.”

Candidly, they’re not going out to buy anything until the coronavirus is under control.

That means even though “demand for our products within China has been affected,” any impact is temporary and expected.

Many Apple and partner stores remain closed in China. Meanwhile, others are only operating at scaled back hours. Understandably, foot traffic in a nation contending with a pandemic is far from robust.

The key? “Outside of China, customer demand across our product and service categories has been strong to date and in line with our expectations.”

What if the coronavirus impact intensifies in duration as many fear, including fellow Forbes contributors, and China becomes a bigger drag on Apple’s business?

We’ve Been Here Before

Been there, done that and the stock’s weathered the storm.

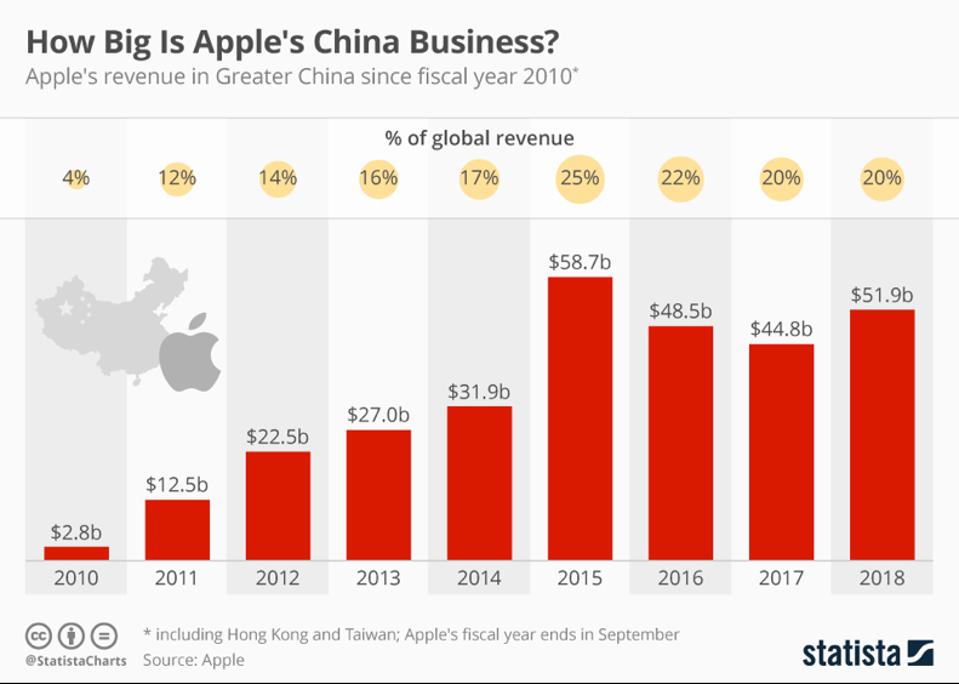

Recall, annual sales in Greater China dipped by double-digits in 2016 and didn’t rebound until 2018.

The cause wasn’t an unexpected health crisis, but rather a serious economic slowdown and destruction in demand.

The result on share prices? Negligible, which is saying something, as China sales accounted for more than 20% of revenue at the time.

- In 2016, Apple’s shares rose a solid 10%, in line with S&P 500’s 9.5% gain.

- In 2017, Apple shares rallied 46%, more than doubling the S&P 500 return.

Keep in mind, this strong stock performance came in spite of serious demand issues in China.

In Terms of Warnings

We’ve been here before, too. Granted, it’s a rarity.

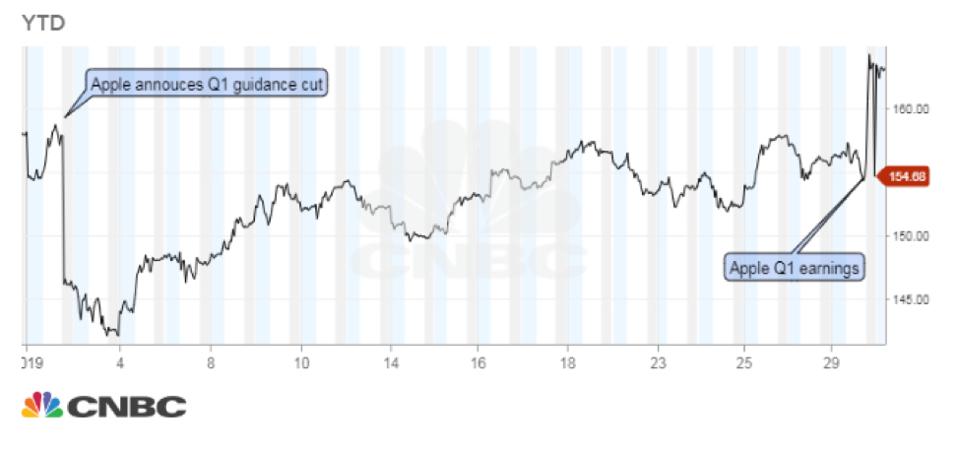

In the last roughly 15 years, Apple has only issued a revenue warning twice. Yesterday and in January 2019.

As Loup Ventures’ Gene Muster points out, though, “This disappointment should be kept in the context that this is not as negative as the Dec-18 miss.”

Not nearly. Therefore, the share price performance in the aftermath of the previous miss is instructive.

Following the January 2, 2019 revenue warning, the stock immediately fell 10%. The very next day shares rebounded 4.5% and kept climbing.

But by January 25, 2019, it was as if the negative guidance never happened. By the end of the year, Apple’s stock rallied nearly 90%.

Another “Buy The Dip” Opportunity

Should Apple shares take a double-digit hit today, history strongly suggests it will be another compelling buying opportunity.

Per Cook, “Apple is fundamentally strong, and this disruption to our business is only temporary.”

“Fundamentally strong” would be an understatement.

Remember, the company is coming off “blockbuster quarter,” per CEO Tim Cook. On almost all fronts.

- Total revenue rose 9% to $91.8 billion.

- iPhone revenue increased 8% to $55.96 billion.

- Services revenue grew 17% year-over-year.

- And Wearables, which includes both Apple Watch and AirPods, enjoyed a 36% uptick in sales to hit a record $10 billion.

You get the point. It’s not like Apple was already in poor health and got sent to the emergency room by the coronavirus. To the contrary, the company’s never been in better health. If there was ever a time to suffer a temporary supply hit and emerge unscathed, it’s now.

Bottom line: When we couple Apple’s strong fundamentals with previous guidance revisions and share price reactions, the takeaway is clear – keep calm, keep perspective and stay long Apple.

This article originally appeared on Forbes.