(Forbes) “Trade wars are good and easy to win,” U.S. President Donald J. Trump said, threatening China with a trade war in 2018.

Sure: Now, tell that to American farmers, who, Politico pointed out, are currently facing “one of the toughest periods for agriculture since the 1980s farm crisis.” Tell it to the assembly workers; the ISM Manufacturing report just reflected the weakest activity in more than a decade. See if any of the investors selling to reduce market exposure this week believe it.

President Trump’s expectations on the trade war aren’t panning out in reality. And for some of the CEOs who dare defy him, there are heady profits to be made. Thinknum Alternative Data tracks job postings from U.S.-based companies internationally, and third-quarter figures reflect that—for some—the time has come to ignore the president and focus on the bottom line.

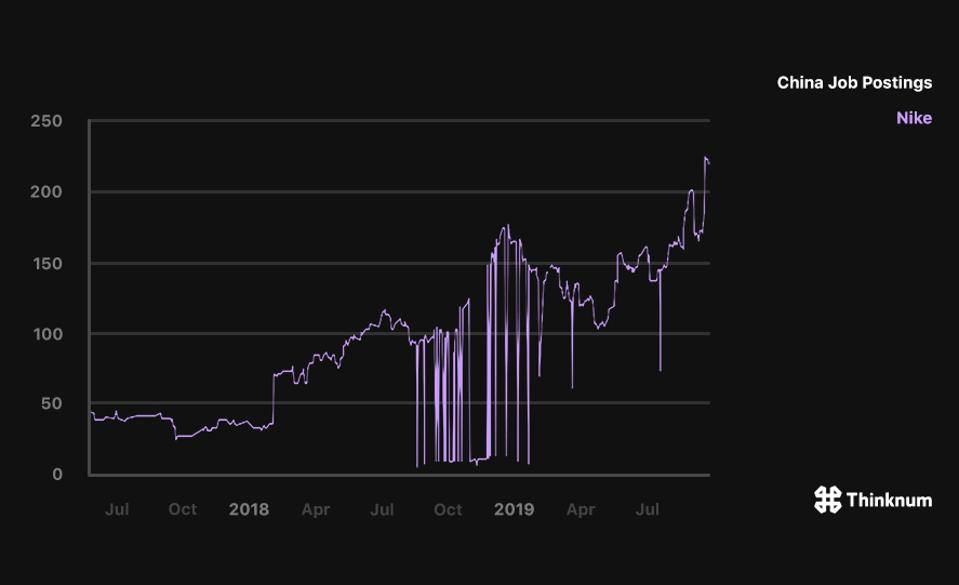

Nike has been a bit of a Wall Street anomaly - its job postings have steadily increased in China throughout the trade war.

THINKNUM ALTERNATIVE DATA

Trump was already at odds with Nike, after he criticized the sneaker maker for working with former NFL player and current activist Colin Kaepernick in an advertising campaign—so the fact that Nike has added China jobs for almost two years likely doesn’t change their relationship. But it matters for Nike, and for their investors.

“Nike is a brand of China for China and the results continue to prove it out,” CEO Mark Parker said on the company’s earnings call in late September. “We’ve driven double-digit growth in Greater China every quarter for more than five years.”

For the American president who in August demanded all U.S. companies leave China, Nike’s move to cater to more Chinese consumers may prove more frustrating than having to see Kaepernick on ads and billboards. Nike grew job postings in China more than 380% 2018 and 35% more in 2019, and now the company’s stock is at an all-time high. Nike is defying the president, and it’s great for Nike’s brand.

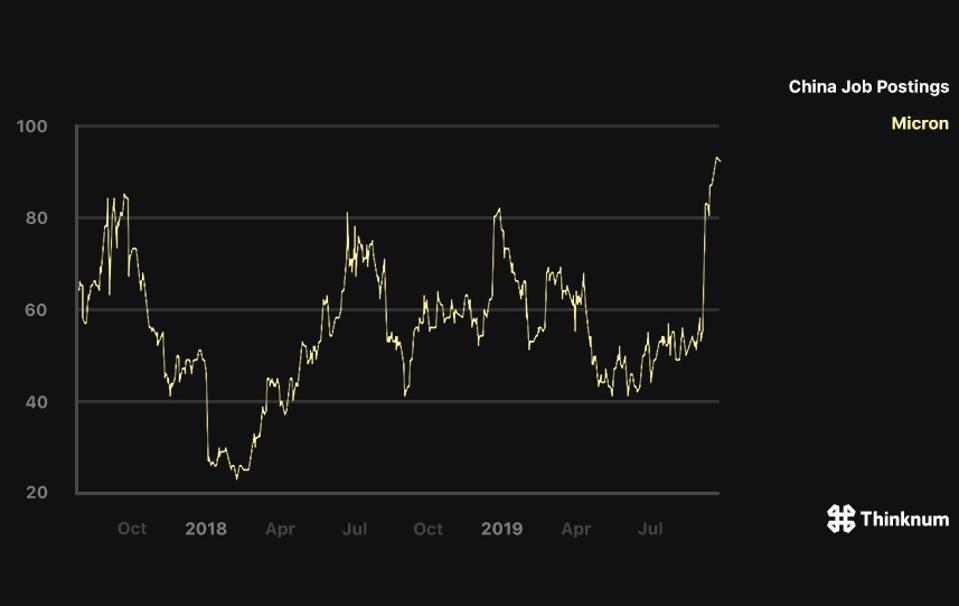

Micron resumed job postings in China in Q3 - and hit a new two-year high before the quarter was through.

THINKNUM ALTERNATIVE DATA

Micron is another example of a U.S. company that depends on China for revenue—in fact, likely its dependency is likely greater than Nike’s, due to its relationship with handset maker Huawei.

Thinknum Alternative Data highlighted declines in Micron’s total job postings to begin 2019, but it recently sought to add dozens of new positions in China, based on its data. Micron more than doubled job postings in China in the third quarter of 2019 until September 23—as it simultaneously cut postings in Taiwan.

Unlike Nike, Micron’s stock continues to suffer in the trade war. And Micron doesn’t seem to expect an improvement with regard to the trade war—even as it kept adding more job postings in China.

“We see ongoing uncertainty surrounding U.S. China trade negotiations,” CEO Sanjay Mehrota said on the company’s September earnings call, adding, “we could see a worsening decline in our sales to Huawei over the coming quarters.”

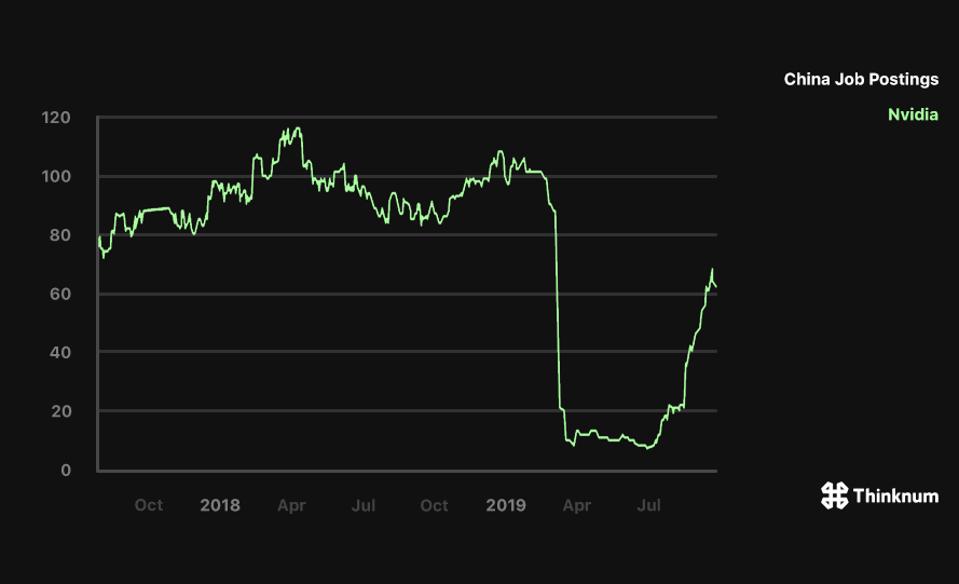

Nvidia - after steep cuts to China job postings - has mostly reversed course in the third quarter of 2019.

THINKNUM ALTERNATIVE DATA

Nvidia has been among the hardest-hit companies from the tech sector that suffered in the trade war. Over the last year, shares have been pounded, losing 40% of their market value. Nvidia’s production and partners are dependent on the company’s ability to do business in and with China, and after a brief and substantial pullback from hiring there, Nvidia dove back in the third quarter of 2019.

Since the second half of the year began, Nvidia added about 60 job postings in China, making up more than half of what it cut late last year.

It remains to be seen how long the trade war will be sustainable for President Trump and not just because of the economic impacts that America’s companies are facing from his lingering beef with Xi. Trump’s trade war has generated collateral damage for American consumers, who are paying more for things like air conditioners, according to Thinknum Alternative Data. Alternative data captures factors like individual product pricing points by retailer, or job posting by role and region—but might not always capture 100% of a company’s products and positions. It does, however, offer a window into forward-looking factors like revenue and hiring.

Today, for nearly every American involved in President Trump’s trade war, it does not seem like this battle was a good one to start. Nor will it be easy to win.