(MarketWatch) - It feels like year-ahead previews just keeping coming out earlier and earlier, now that many Wall Street firms are having them finished before the table is laid for Thanksgiving. It isn’t a terribly productive exercise — most assessments find that forecasts have very little predictive value beyond three months — but they can at times be thought-provoking.

For example, pretty much everyone believes the Federal Reserve will raise interest rates next year. The Fed itself is forecasting one hike, if you believe the dot plot, and futures markets imply two or three increases.

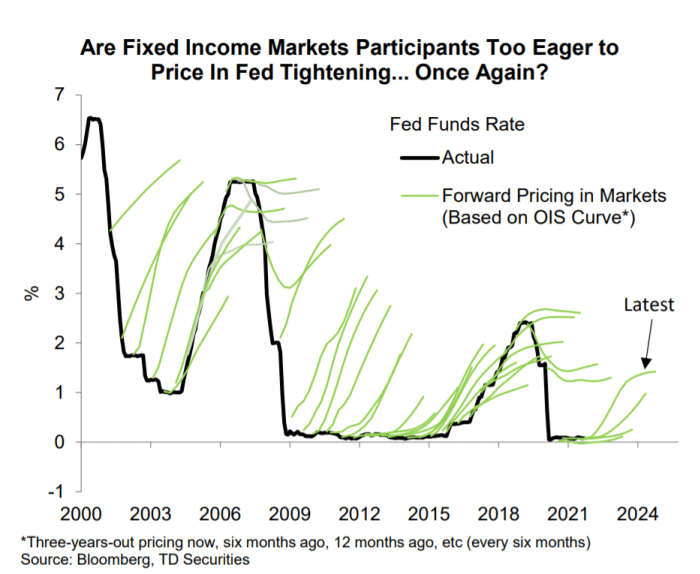

TD Securities, the Canadian brokerage that’s also a primary U.S. Treasury dealer, is notable in predicting zero interest-rate hikes next year. “We expect that markets will be biased towards earlier tightening from the Fed, but where others have buckled, we look for the Fed to hold firm. Tapering buys time before it has to consider lifting rates, and with U.S. growth expected to decelerate through 2022 we don’t see much incentive for the Fed to lift rates next year,” it says.

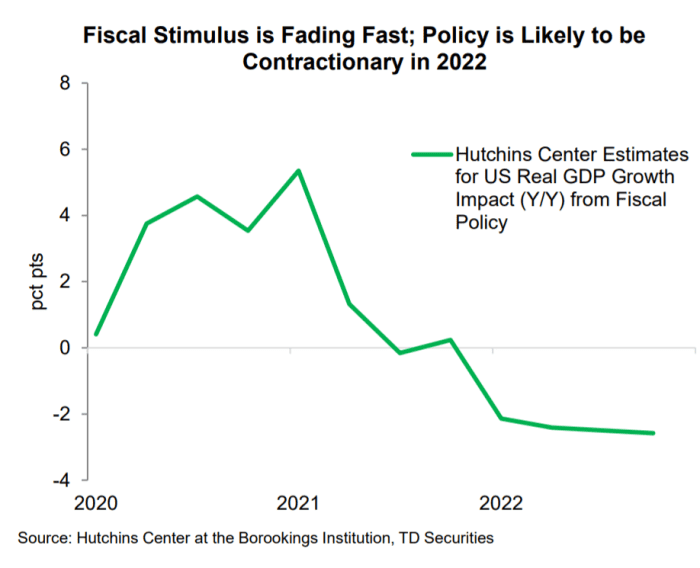

The Fed still has a dual mandate, TD Securities notes, and the employment-to-population ratio is still 2 percentage points below pre-pandemic levels. It expects supply-chain disruptions to ease “more forcefully” in the second half, the withdrawal of policy stimulus to slow growth momentum and a decline in energy prices to ease inflation.

The federal deficit will plunge to 5% of gross domestic product from 12%, TD forecasts, which will be especially negative for goods consumption. The savings rate already has normalized, and excess savings appear to be held by above-average income individuals with lower propensity to spend, it says.

Furthermore, productivity will slow to more sustainable rates, and labor-force participation will gradually improve, which will put less pressure on companies to lift wages.

The bank also predicts a weaker dollar DXY, -0.04%, though it sees the greenback bottoming out around the middle of the year, which is about 12 months away from when it expects the Fed to finally lift interest rates. Gold could reach $1,900 an ounce in the first half of 2022. Other calls: it is short U.S. 10-year Treasurys, as it sees yields rising to 2% by the end of 2022; it is short copper HG00, -1.60% on expectations previously disrupted smelters will restart and elevated prices will encourage increased capacity; and it is long platinum and palladium on expectations of a recovery in auto demand.

By Steve Goldstein

Wed. 11/17/2021