The ballooning federal budget deficit under President Donald Trump will force the U.S. to borrow more than $1 trillion this year and risks worsening the frenzy behind the global sell-off in stock markets.

The budget deal Senate leaders reached late Wednesday would add nearly $300 billion in government spending over two years and push the deficit higher. Even beforehand, Bank of America Corp. senior U.S. economist Joseph Song warned in a report that the federal deficit was on track to exceed 5 percent of gross domestic product by 2019, by far the largest for the economy while at full employment since World War II.

That is “exactly the opposite of what the economic textbooks say lawmakers should be doing,” Mark Zandi, chief economist of Moody’s Analytics Inc., said in an email. “Deficit financed tax cuts and spending increases in a full-employment economy will result in more Fed tightening and higher interest rates.”

The combined impact on the deficit of the Republican tax cuts and the spending deal over the next two years will likely exceed the $580 billion President Barack Obama’s economic stimulus added in 2009 and 2010 during the depths of the recession.

Investors remained on edge Thursday as the resurgent threat of inflation and higher bond yields renewed concerns that rising interest rates will drag on the economy. The Dow Jones Industrial Average plunged more than 1,000 points and the broader S&P 500 index fell 3.75 percent Thursday -- down more than 10 percent since its Jan. 26 peak.

“An increase in debt instruments, people dumping bonds and concerns about higher inflation -- that is a toxic combination,” said Alexis Crow, head of PricewaterhouseCoopers LLP’s geopolitical investing group in New York. “Since the crisis, debt has not disappeared. It’s an unsustainable situation.”

White House Deputy Press Secretary Raj Shah defended the Trump administration’s commitment to reducing the deficit at a press briefing Thursday.

“I know some of the numbers have more to do with the previous administration’s accounting than it has to do with this administration’s policies, but I would say we are committed to fiscal discipline and the budget next week shows that in greater detail,” Shah said.

In the short term, the combination of tax cuts and more government spending will throw fuel onto the economy, boosting growth, employment and probably wages. Zandi estimates the spending deal alone, if passed by Congress and signed by Trump, could add as much as 0.4 percent to economic growth this year and 0.2 percent next year, raising his growth forecast to 3.1 percent in 2018 and 2.3 percent in 2019.

But investors in Treasuries, which pay fixed payments over the life of the security, are wary of inflation, which erodes the value of their income. The 10-year Treasury yield, the key benchmark for global rates including many U.S. mortgages, reached 2.88 percent this week - its highest since January 2014 and up from 2.41 percent at the end of last year. The 30-year bond yield is now above 3 percent.

“Some participants that I’ve talked to have said, look, you know, they’re suddenly realizing that Treasury is going to be doubling the amount of debt issuance,” Patrick Harker, president of the Federal Reserve Bank of Philadelphia, told reporters Thursday. “I think that was not fully baked into some people’s thinking.”

A Treasury auction on Thursday underscored the concerns. The $16 billion 30-year U.S. bond sale drew a yield of 3.121 percent, higher than indicated before the offering. Indirect bidders, a class of investors that includes pensions and mutual funds, purchased 61.2 percent, the least since September.

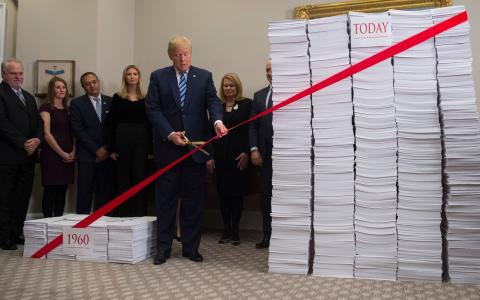

The tax cuts and spending increases are kicking in as the deficit already was rising. The retirement of Baby Boomers adds to Social Security and Medicare costs. The Federal Reserve’s rate increases also raise the cost of interest payments on the U.S. debt.

While there is nothing Mnuchin can really do to calm the stock market, his increase in debt sales in part to finance fiscal initiatives is part of the problem, said Edward Yardeni, president of Yardeni Research Inc. in New York, who coined the term “bond vigilantes” in the 1980s to describe investors who sell bonds to protest monetary or fiscal policies they consider inflationary. Fear of the effects of more than $1 trillion in added Treasury debt this year has been part of the force behind rising yields.

“One of the concerns is that the deficit will widen,” said Yardeni by phone.

JPMorgan Chase & Co. strategists last month lifted their forecast for net new Treasury debt in 2018 by about $100 billion, to around $1.42 trillion, after the passage of the tax bill. Net sales in 2017 totaled about $550 billion.

Against a backdrop of solid economic fundamentals -- synchronized growth and strong corporate earnings -- investors would normally step in to buy the dip, but government rates remain under pressure and this week’s Treasury auctions have underwhelmed, raising the prospect that the debt selloff could resume.

Mnuchin on Tuesday said the increase in debt issuance is not contributing to market volatility. “The debt markets are one of the most liquid markets in the world and are reacting very well.”

Some economists agree. While the tax plan will increase federal borrowing, it’s not the main driver over the next 10 years, said Brian Riedl, a senior fellow at the Manhattan Institute and a former chief economist for Ohio Senator Rob Portman. “Even without the tax cuts, we would be facing a huge deficit this year,” he said.

“There’s no appetite in Washington for fiscal discipline, period,” Riedl said. “The election of President Trump has convinced Congress that voters don’t care about the deficits.”