(The Motley Fool) - What happens when a guy wearing a hockey mask and holding a sharp object appears in a horror movie? Nothing good.

While perhaps not quite as scary as the sinister villain of pop culture, there's an arguably frightening indicator on the scene with the economy right now. U.S. money supply is shrinking the most since the Great Depression. Does this mean an economic and stock market meltdown is on the way?

A horrifying history

Economists pay close attention to money supply -- the total amount of money in circulation. They measure money supply in a couple of primary ways. M1 is the metric used for the total amount of money that the American public holds in coins and paper currency, easily accessible checking and savings accounts, and other accounts that can quickly be converted to cash. M2 includes all the money in M1 plus funds held in short-term time deposits like money market funds and certificates of deposit (CDs).

Typically, M2 money supply rises over time. When it does contract, the decline is usually very small. But whenever M2 has shrunk by several percentage points in the past, it's been bad news.

Reventure Consulting's Nick Gerli analyzed the history of M2 going back to 1870. He found that there have been four times over the last 154 years when this money supply metric fell by 2% or more. Two of those instances were in the 19th century -- 1878 and 1893. The other two occurred in 1921 and 1931 through 1933.

What was the result? According to Gerli, every single time M2 shrank by at least 2%, a depression combined with double-digit unemployment rates followed closely behind. As you might imagine, such conditions almost always translate to rough periods for stocks.

What's happening now with M2 money supply?

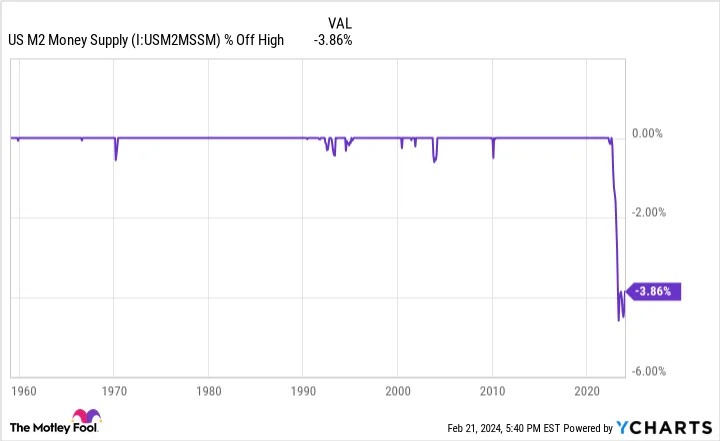

Fast-forward to today. M2 money supply is contracting the most since the 1931 through 1933 stretch (during the Great Depression).

US M2 Money Supply Chart

Granted, the current M2 decline of nearly 4% is nothing compared to the money supply contraction of almost 30% that occurred during the early years of the Great Depression. However, it's close to double the decline experienced in 1921.

Why have significant M2 declines been so problematic in the past? When money supply is lower, there's less cash available to individuals and businesses. Consumer spending can fall. So can investment levels. This can ultimately lead to deflation, which is a major fear for many economists.

Fear not?

So, with M2 money supply shrinking the most since the Great Depression, is an economic and stock market meltdown on the way? Probably not.

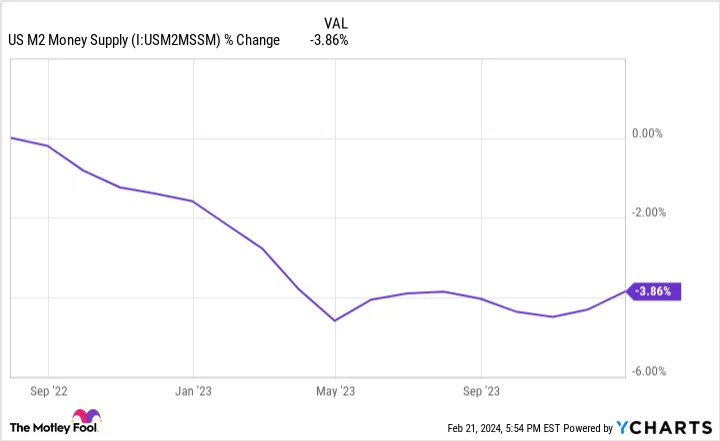

For one thing, M2 appears to have stabilized in recent months. So far, there have been no signs of the economic and stock market turmoil that followed declines of 2% or more in the past.

US M2 Money Supply Chart

There could be a simple reason why history won't repeat itself with the current M2 contraction. We don't use cash nearly as much as people did in the past. Many Americans now instead use credit and debit cards or digital payment methods such as Apple Pay, Alphabet's Google Pay, Cash App, PayPal, Venmo, and Zelle.

Goldman Sachs economist Manuel Abecasis argued in a report released last year that M2 money supply has "been unreliable for forecasting the economy for several decades." James Bullard, president of the Federal Reserve Bank of St. Louis, thinks that the declining M2 level could even help the U.S. economy avoid a recession by helping bring inflation down.

The bottom line is that the current M2 decline might not be like a horror movie for investors after all. Fear not -- at least, for now.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has nearly tripled the market.*

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keith Speights has positions in Alphabet, Apple, and PayPal. The Motley Fool has positions in and recommends Alphabet, Apple, Goldman Sachs Group, and PayPal. The Motley Fool recommends the following options: short March 2024 $67.50 calls on PayPal. The Motley Fool has a disclosure policy.

U.S. Money Supply Is Shrinking the Most Since the Great Depression. Is an Economic and Stock Market Meltdown on the Way? was originally published by The Motley Fool.

By Keith Speights | The Motley Fool