President Joe Biden is due to present his infrastructure spending plan on Wednesday, the opening salvo in getting legislation through Congress to fix crumbling roads and bridges.

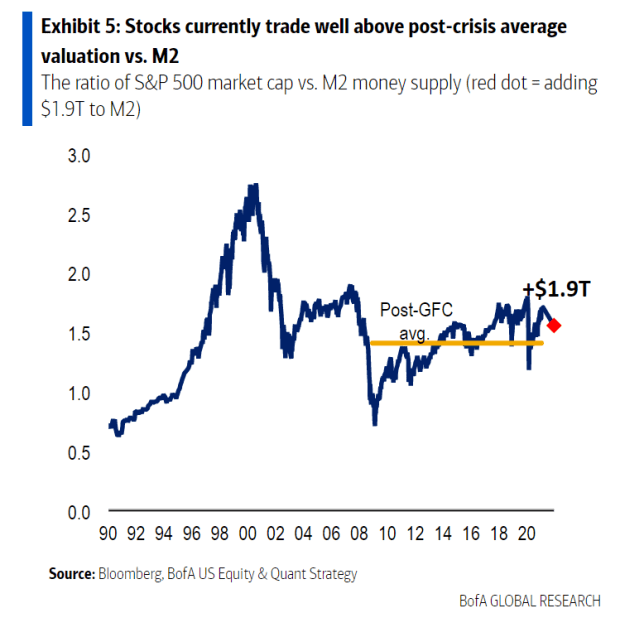

Strategists at Bank of America led by Savita Subramanian say Wall Street already is starting to price in infrastructure spending that could reach $4 trillion. They say the ratio of the S&P 500’s market cap to the M2 measure of money supply is an unusually high 1.7, compared with the average of 1.4 since the 2008 financial crisis.

There is also the downside as well, as the market reacts to likely corporate tax hikes and the rise in the 10-year Treasury that lifts corporate debt expenses. “Infrastructure spending is spread out over years, but a corporate tax hike would hit immediately,” they say.

Industrials and materials will likely be the biggest beneficiaries of an infrastructure bill, along with U.S. small-caps, whose sales are highly correlated to U.S. capital spending cycles, the strategists say.

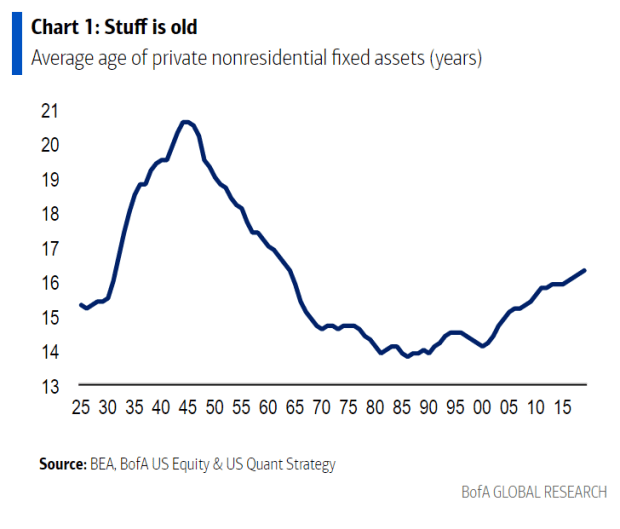

But which ones? The strategists screened S&P 500 companies, back to 1986, to find the highest sales growth sensitivity to the components of U.S. private nonresidential fixed investment.

For the highest sales sensitivity to nonresidential fixed investment in structures, it is a group led by pipeline owner Kinder Morgan, exchange operator Intercontinental Exchange, oil field equipment operator NOV, stock-exchange owner Nasdaq, and healthcare real-estate investment trust Ventas .

For the highest sales sensitivity to technology equipment investment, it is pharmaceutical Incyte, microchip equipment maker Lam Research, electric utility Centerpoint Energy, cloud services company NetApp, and chip equipment maker Applied Materials. The highest sales sensitivity to industrial investment includes some of the same companies: Incyte, biotech Vertex Pharmaceuticals, home-energy technology maker Enphase Energy, Lam Research, and fertilizer maker CF Industries.

The highest sales sensitivity to intellectual property investment were network services provider Akamai Technologies, travel services provider Booking Holdings, internet retailer Amazon.com, network equipment maker Juniper Networks, and network services firm F5 Networks.

The strategists also looked at companies that would benefit from reshoring, which include paper and packaging firm WestRock, Ventas, CenterPoint Energy, high-tech lender SVB Financial and natural-gas distributor Duke Energy.

What Biden’s First 100 Days Mean For You and Your Money

How will the new stimulus package affect the economy? Understand how today’s market dynamics, tax policies and more impact you with real-time news and analysis from MarketWatch. Our instant market data and insights will help you take action immediately—no matter your investing experience.

Waiting for Pittsburgh

Biden is due to deliver remarks in Pittsburgh on infrastructure spending shortly after trading ends, at 4:20 p.m. Eastern. The White House said what is called The American Jobs Plan will include $2 trillion in spending over 10 years and will be fully paid for with $2 trillion in taxes over 15 years, including by hiking the corporate tax rate to 28%, increasing the global minimum tax on U.S. multinationals and establishing what is called a 15% minimum tax on book income. Published reports say the White House will lay out plans for roughly $2 trillion more in spending on education and healthcare in a month’s time.