First, the contagion, and seemingly, next, the recession.

Wall Street and financial services job postings have been viewed as a reliable barometer for the US’ economic prospects, and right now, warning lights are flashing everywhere as top hedge funds and banks pare job postings.

US banks’ forthcoming earnings will provide more of a window into C-suites’ contingency and response planning, than to offer forward-looking guidance. Between the uncertainty facing small businesses and corporate clients alike, and regulatory changes as Wall Street turns to Washington officials to tweak policies to bolster future economic activity, it would likely prove faulty or incomplete at best.

“The country was not adequately prepared for this pandemic,” JPMorgan Chase CEO Jamie Dimon wrote to shareholders in his annual letter released Monday April 6, adding “it will include a bad recession combined with some kind of financial stress similar to the global financial crisis of 2008. Our bank cannot be immune to the effects of this kind of stress.”

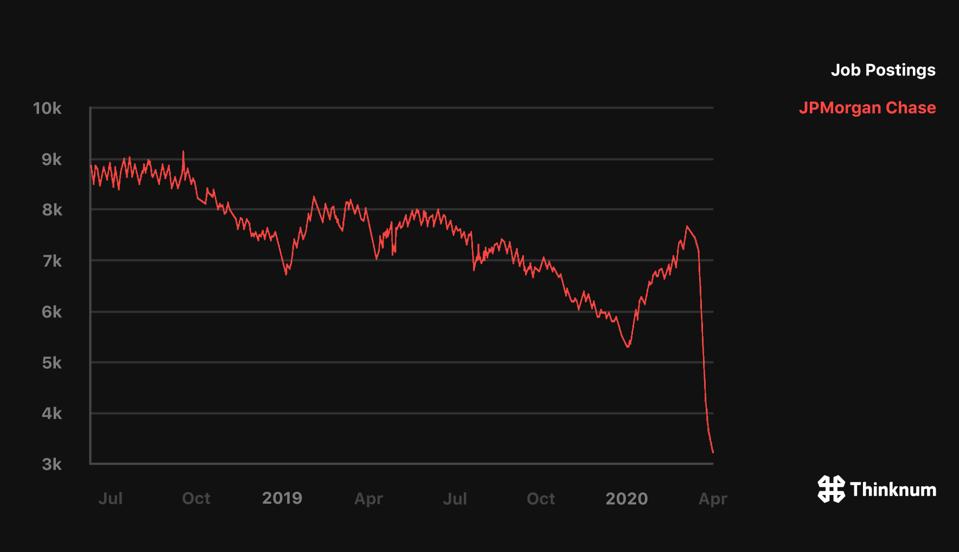

JPMorgan Chase job postings fell 57% from mid-March until the beginning of this month, according to Thinknum Alternative Data, a sign that the bank’s growth plans are certainly also not immune to the stress brought on by the global Coronavirus pandemic.

Of course, it’s not just Jamie Dimon’s bank; Wall Street saw job cuts first as nearly every major financial services leader was forced to recalibrate.

Goldman Sachs job postings declined 34% from mid-March to early April, Thinknum Alternative Data reflects, and other US financial services leaders including Bank of America and Citigroup made similar moves as JPMorgan Chase.

It’s a trend that has taken root on both sides of the Atlantic.

In the EU and UK, Credit Suisse, Royal Bank of Scotland and UBS have also made substantial cuts to job postings, as the global pandemic also casts a pall on hiring.

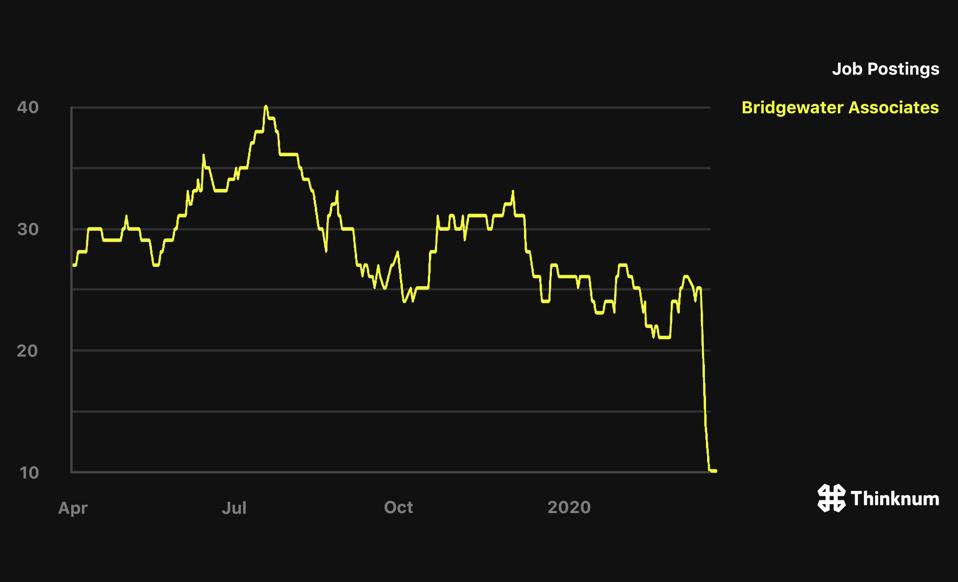

Hedge funds and institutional investors, too, scrambled to recalibrate amid the crisis. Bridgewater Associates slashed job postings 62% last month and Blackrock (not pictured) cut even more.

Later in Dimon’s annual memo, he says, “we do not know how this crisis will ultimately end, including how long it will last, how much economic damage it will do, or how fast or slow the recovery will be.”

But if Wall Street’s hiring is to be trusted as a leading indicator for the US, the damage is already substantial, and the recovery may not come as fast as optimists hope.

This article originally appeared on Forbes.