(The Motley Fool) - For nearly six decades, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett has been dazzling Wall Street with his investing prowess.

Even though he and his team aren't going to be right 100% of the time, the ability to locate plain-as-day values has led to an aggregate return on Berkshire's Class A shares (BRK.A) of greater than 5,000,000% since becoming CEO in the mid-1960s.

Professional and retail investors tend to pay particular attention to Berkshire Hathaway's quarterly 13F filings, which provide a snapshot of what Buffett and his team have been buying and selling, as well as Berkshire's quarterly operating reports, which offer insight into how Buffett and his team have deployed their company's capital, as a whole.

Although the $371 billion portfolio Buffett and his investing aides, Todd Combs and Ted Weschler, oversee at Berkshire Hathaway has been a source of inspiration for investors spanning the course of many decades, the last five quarters (since Oct. 1, 2022) have given optimists little to cheer about.

Warren Buffett's short-term actions and long-term mindset aren't always aligned

If there's one pretty consistent takeaway from the 47 years of shareholder letters the Oracle of Omaha has written to his investors, it's that betting on America to thrive over long periods is a smart move. Buffett has always gravitated toward businesses with strong brands, time-tested management teams, and sustained competitive advantages. It's why he's been holding continuous stakes in companies like Coca-Cola and American Express since 1988 and 1991, respectively.

But just because Warren Buffett wouldn't bet against America, it doesn't mean he's willing to overpay for perceived-to-be high-quality businesses.

During the December-ended quarter, Berkshire Hathaway purchased $7.32 billion in equity securities. By comparison, Buffett's company sold $7.845 billion in equity securities. Though this works out to "just" $525 million in net-equity sales, it's been a theme for Buffett and his aides for five consecutive quarters. For example:

-

For the quarter ended Sept. 30, 2023, Buffett was a net-seller of $5.253 billion of equities.

-

For the quarter ended June 30, 2023, Buffett and his team oversaw $7.981 billion in net-equity security sales.

-

For the quarter ended March 31, 2023, Buffett and his aides completed $10.41 billion in net-equity security sales.

-

For the quarter ended Dec. 31, 2022, Buffett's team was a net-seller of $14.64 billion of equities.

Added together, Buffett, Combs, and Weschler have overseen an aggregate of $38.8 billion in net-equity security sales in a 15-month stretch. That's a roughly $39 billion silent warning that Wall Street appears to be ignoring at the moment.

Stocks are pricey, and Warren Buffett wants no part of the "casino"

It's no secret why the Oracle of Omaha and his team have been pressing the sell button far more often than the buy button since October 2022: Stocks are pricey.

Although Buffett isn't the type of investor to make downside predictions in the stock market, his latest annual letter to shareholders speaks volumes. Said Buffett:

Though the stock market is massively larger than it was in our early years, today's active participants are neither more emotionally stable nor better taught than I was in school. For whatever reasons, markets now exhibit far more casino-like behavior than they did when I was young. The casino now resides in many homes and daily tempts the occupants.

To reiterate, Warren Buffett would never, ever advocate investors bet against America. But he pretty clearly laid out in his latest shareholder letter why he and his team aren't being more aggressive with their capital: Namely, there aren't many good deals.

S&P 500 Shiller CAPE Ratio Chart

The most telling valuation indicator that suggests equities could be in trouble is the S&P 500's Shiller price-to-earnings (P/E) ratio, which is also known as the cyclically adjusted price-to-earnings ratio (CAPE ratio). This is a valuation tool based on average inflation-adjusted earnings from the previous 10 years, which means it helps to smooth out one-time events, such as the COVID-19 pandemic.

For more than 150 years, the Shiller P/E has averaged a reading of 17.09. On Feb. 23, it closed at roughly double this value (34.25). It's one of the highest readings during a bull market rally in history.

What's even more telling is what's happened the previous five times the S&P 500's Shiller P/E surpassed 30 during a bull market rally. Eventually, the S&P 500 and/or Dow Jones Industrial Average went on to lose 20% to 89% of their respective value following each prior instance. Although the Shiller P/E ratio isn't a timing tool and can't forecast when the broader market will head lower, history suggests that an expensive market eventually corrects lower in a big way.

While Buffett rarely, if ever, thinks short term, five consecutive quarters of net-selling from Berkshire Hathaway speaks volumes.

Patience has paid off handsomely for Warren Buffett and Berkshire Hathaway's shareholders

As of the end of 2023, Berkshire's cash pile swelled to an all-time record $167.6 billion. Having this much capital that could be put to work and not doing so may be viewed as a major disappointment by Berkshire's shareholders and the investing community as a whole. But in the eyes of Warren Buffett and his team, which until recently included the affably named "Architect of Berkshire Hathaway," Charlie Munger, there's solid reasoning behind this approach.

In Warren Buffett's recently released letter to shareholders, he reiterated an investing rule that his company simply will not break:

One investment rule at Berkshire has not and will not change: Never risk permanent loss of capital. Thanks to the American tailwind and the power of compound interest, the arena in which we operate has been -- and will be -- rewarding if you make a couple of good decisions during a lifetime and avoid serious mistakes.

Even though Berkshire's brightest investment minds are well aware that downturns in the U.S. economy and stock market are perfectly normal, they recognize that periods of growth for the U.S. economy last substantially longer. Whereas no recession since the end of World War II has surpassed 18 months in length, two periods of economic expansion have reached the decade mark during this span. This demonstrates the power of the "American tailwind," as well as the value of time and perspective on the part of individual investors.

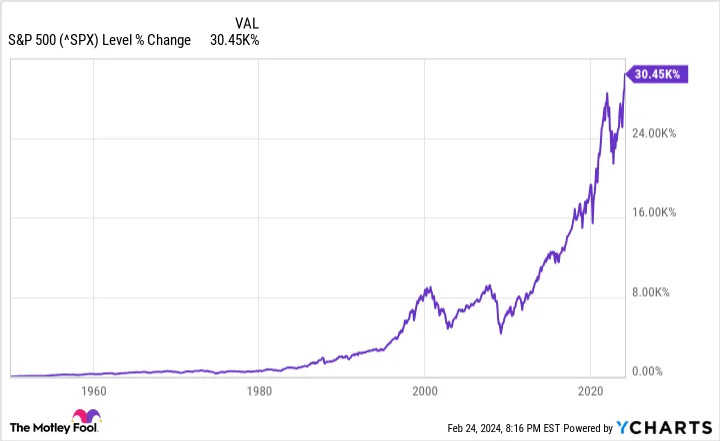

^SPX Chart

It's a similar story for the broader market. According to data released last year by researchers at Bespoke Investment Group, the average S&P 500 bear market has lasted just 286 calendar days since the start of the Great Depression in September 1929. By comparison, the typical S&P 500 bull market has stuck around 1,011 calendar days, which is 3.5 times longer than the average bear market.

Furthermore, the Oracle of Omaha isn't looking to make smaller investments. He and his aides are after needle-moving, wonderful companies at a perceived-to-be fair price. They're willing to sit on their hands until a large-scale opportunity presents itself.

Although Warren Buffett being a net-seller of stocks over the past five quarters may not have been on many investors' bingo cards, he and his team have a boatload of cash that should eventually get put to work.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 26, 2024

American Express is an advertising partner of The Ascent, a Motley Fool company. Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

Warren Buffett Just Sent a $39 Billion Silent Warning to Wall Street was originally published by The Motley Fool

By Sean Williams, The Motley Fool