The holiday season is a time when many professionals send gifts and cards to their clients to thank them for their business and support. Within the financial advisory and planning industry, these gifts often foster stronger advisor-client relationships. They serve as tokens of appreciation for clients’ continued trust and confidence in their investment strategies and decisions.

This holiday season, SmartAsset grew curious about financial advisors’ plans for client gifts. SmartAsset serves as a marketplace for financial advisors, and in that capacity, we surveyed financial advisors on our SmartAdvisor platform to get a better sense of what gifts advisors plan to send their clients around the holidays. We surveyed roughly 200 financial advisors about their gift-giving plans for clients. For more information on our data and how we put it together, check out our Data and Methodology section below.

Key Findings

- About half of financial advisors plan to send holiday gifts to their clients. Our survey data shows that 93 out of 192 financial advisors – 48.44% – plan on sending appreciation gifts to their clients in 2020. About 20% of advisors are undecided whether they will send a gift, and the remaining roughly 31% of advisors do not intend to send gifts.

- Most advisors are not spending less on client gifts this year. In general, the amount of spending on client holiday gifts is comparable to last year. Four in five financial advisors plan to spend the same on holiday gifts for clients this year relative to 2019. However, about one in five advisors plans to shift the amount spent on gifts. Among financial advisors in this survey, 16.19% report that they will spend more on client gifts around the holidays this year than last, while less than 4% say they will spend less.

Holiday Gifts for Clients: Popular Items and Typical Cost

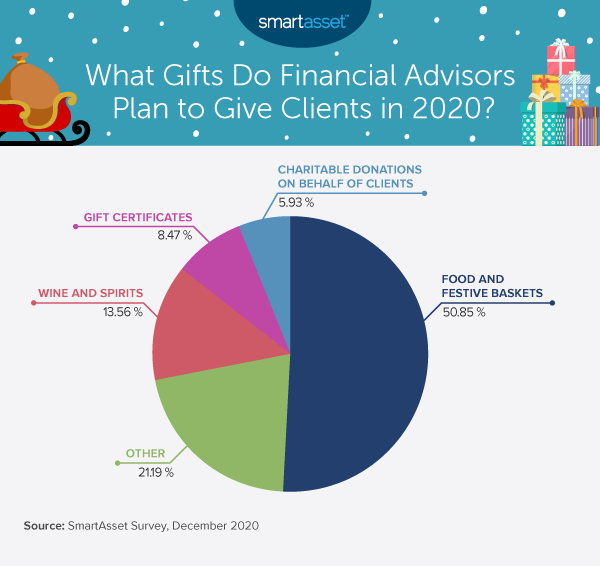

Food or festive baskets are the most popular gifts financial advisors plan to send to their clients. More than 50% of advisors responded that if they were to send a gift, that would be their top choice. Wine and spirits are the second-most popular common response, with about 14% of financial advisors listing that as their planned client gift.

If you're looking to give wine or spirits, check out this Spirited Holiday Gift Guide.

Roughly 21% of financial advisors responded “Other,” completing a free response on what they plan to give clients. Interestingly, those responses show that many financial advisors plan on sending customized or personalized gifts to their clients, perhaps building even stronger relationships. Some of the responses include personalized calendars, monogrammed blankets and various other custom items.

Financial advisor gifting to clients is commonly regulated by reference to the Investment Advisors Act’s anti-fraud provision. Both the Financial Industry Regulatory Authority (FINRA) and Securities Exchange Commission (SEC) also regulate gifts to clients, meaning that financial advisors’ restrictions vary according to their registrations. FINRA has a set limit, restricting advisors from giving gifts in excess of $100 per client, per year – with some exceptions. Meanwhile, the SEC does not have a codified gift limit, though its Code of Ethics includes a clause on “moderate gifts and entertainment.” In general, advisory firms usually set their own gift limit policies that can be as restrictive as the FINRA policy or looser – as long as gifts are not determined to be extravagant or a conflict of interest.

The financial advisors we surveyed generally follow FINRA guidelines when it comes to holiday gifts. Almost 94% of financial advisors plan to spend less than $100 on holiday gifts per client – with about 65% planning to spend less than $50 and roughly 29% planning to spend between $50 and $99.99. The remaining roughly 6% of financial advisors estimated that their holiday gifts for clients would exceed $100 per client.

Data and Methodology

SmartAsset collected survey data for this report between December 1, 2020 and December 14, 2020. We asked financial advisors the following questions:

- Do you plan on sending appreciation gifts to your clients this year?

- If you were to send a gift, how much would you plan on spending relative to last year?

- If you were to send a gift, how much would you intend to spend per client?

- If you were to send a gift, what would you plan to send?

In total, 192 financial advisors responded to our survey. For the second, third and fourth holiday gift-giving questions, we did not include financial advisors who responded “Does not apply” in our analyses.

Tips for Sourcing Clients in the New Year

- Look for prospects in unexpected places. Between March and August of 2020, online searches for the term “financial advisor” jumped by nearly 20%, but many advisors weren’t able to capitalize on the trend. While it can take some time to build a brand for your firm online, some lead generation services can help you scale quickly.

- Expand your radius. Many financial advisors rarely look for prospects outside of a short drive from their home or office. But 60% of prospects who completed a survey with SmartAsset indicated that they were willing to work with an advisor remotely. Consider broadening your search and working with investors who are more comfortable with less frequent in-person meetings.

- Consider younger investors. While investors who are closer to retirement often have more assets, investors from Generations X and Y are rapidly catching up. Get ahead of the Great Wealth Transfer by expanding your client base and working with investors who are entering their prime earning years.

For the best spirits to give your clients, check out the Spirited Holiday Gift Guide.

This article originally appeared on Kake.