(Seeking Alpha) Along with several others on Seeking Alpha (Dane Van Domelen, Jonathan Cooper, Charlie Bilello, and Greg Hudson come to mind), I have written about the effectiveness of leveraged ETF strategies in the long run. The thesis is simple. Leveraged ETFs are capable of making investors large sums of money over multi-year and even multi-decade periods. Each of these authors has written about leveraged ETFs from a slightly different angle, and all have shown that the idea of investing in leveraged ETFs, at a minimum, can't be disproven either by historical data or finance theory.

In order to add to the understanding of leveraged ETFs on Seeking Alpha, I've decided to show some longer-term tests that include the effects of the 2008 global financial crisis on investors in leveraged ETFs.

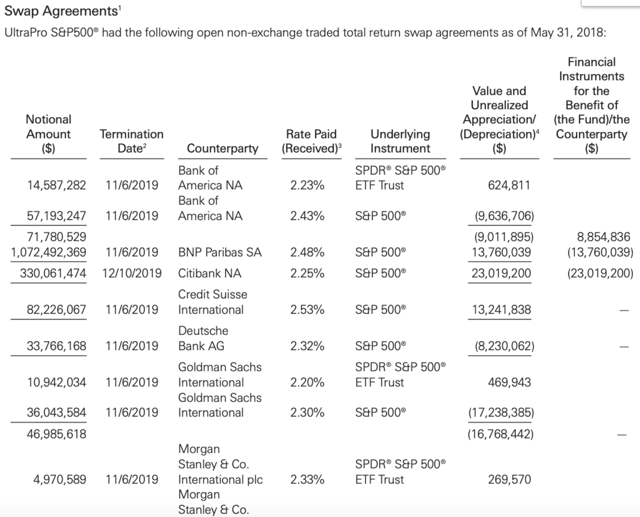

But first, a little theory. The most popular 3x leveraged ETF (UPRO) is 300 percent long the S&P 500 and short 200 percent cash, rebalanced daily. Therefore, you earn 3x the daily return of the S&P 500 (SPY) and pay (roughly) 2x the return of the three-month LIBOR. This explains what some observers have described as decay.

I found this figure, along with a pretty interesting discussion on a Bogleheads leveraged ETF thread. The financing rates have since come down along with all other short-term interest rates. The fund also charges a 0.95 percent per year expense ratio, but this is on the NAV rather than the gross.

I'll go ahead and share an old formula for the optimal amount of leverage also, while I'm at it.

Optimal leverage (for maximum CAGR) = asset return- financing cost /(standard deviation ^2)

Interestingly, two of the three variables in the above equation (volatility and interest rates) are fairly easy to predict over the next month. An increase in either of these variables calls for a reduction in equity risk.

This formula historically gets you roughly 3.3x leverage on the S&P 500. However, closer to 2x leveraged is going to be a more reasonable ride for most investors and leaves some margin of safety if markets are more volatile in the future than they have been in the past. I still like UPRO at 3x at times, but I would look to combine it with some more sophisticated risk management, such as volatility targeting. I actually have a model that predicts the one-month risk-adjusted return of the S&P 500 in excess of cash - it's very useful for this!

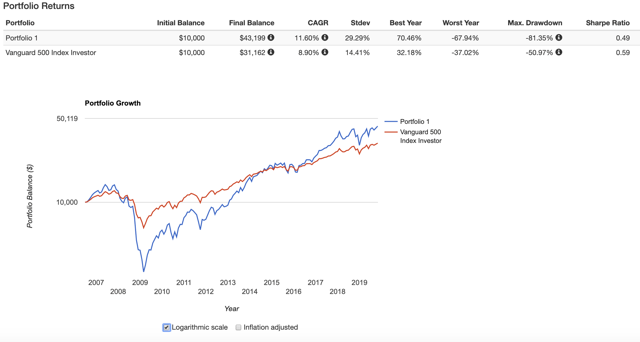

Here's the original 2x leveraged ETF (SSO) since inception in July 2006 (log scale).

Source: Portfolio Visualizer

The results are superior, but aren't overly impressive, for a few reasons. First, the 0.95 percent annual fee eats into the returns. Second, the returns are highly path-dependent.

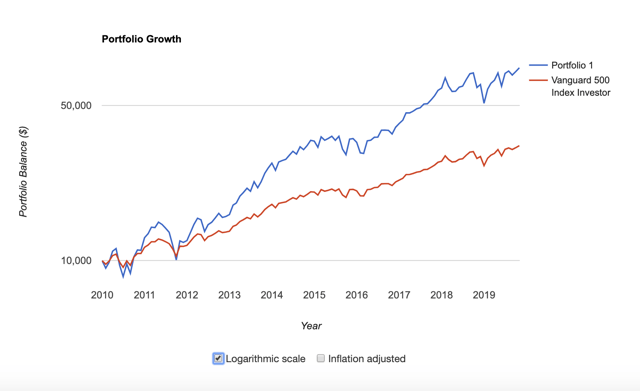

For example, here are your returns if you started in 2010. Much better!

Source: Portfolio Visualizer

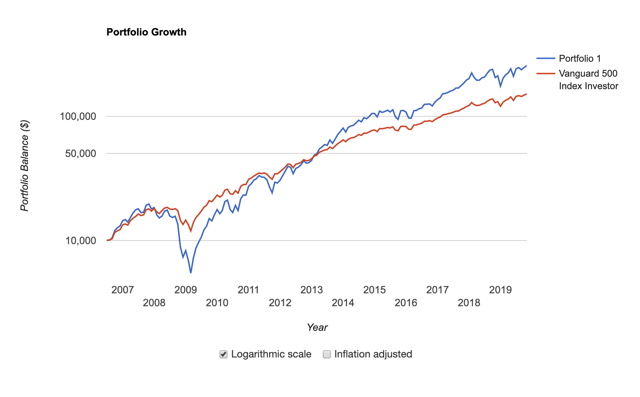

Dollar-cost averaging is the classic solution to time concentrated market risk. Here are your returns if you add money over time as I suggested in my article about life-cycle investing using leverage.

Source: Portfolio Visualizer

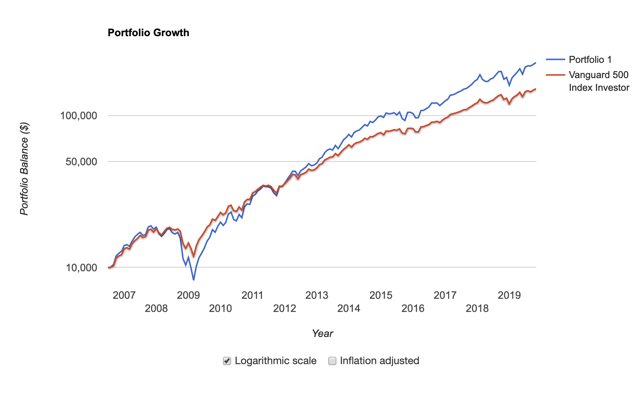

Finally, here are your returns if you add money but leverage a portfolio of stocks and bonds, and rebalance over time.

Source: Portfolio Visualizer

Feel free to thumb through the portfolio links to see what looks best. I tried not to optimize anything here, but rather used popular rules for portfolio construction to see how they each performed. The best portfolio on a risk-adjusted basis is the stock/bond portfolio with leverage. The highest CAGR is the 2x leveraged S&P 500 with dollar-cost averaging. I expect risk parity and volatility targeting on a diversified portfolio of futures to outperform all of these, as the correlation to equity markets in the above portfolios exceeds 95 percent in every case.

Takeaways

1. Leverage tends to boost your CAGR, but makes your portfolio much more volatile and path-dependent.

2. Dollar-cost averaging/rebalancing of leveraged portfolios tends to reduce volatility and path dependence.

3. It's cheaper to get leverage on a variety of risk exposures through the futures market. Risk management isn't built into futures, however, so if you're not managing risk well, you could lose a lot of money. For this reason, I encourage professionals to use futures but caution retail investors about them.

4. I stand by my recommendation that young investors can use leveraged ETFs and dollar-cost average. There are many risks in life, and the long-run returns of the stock market are only one of them. Building capital early in life through taking risk can cover expenses later in life. For example, if you were to have a parent who needs memory care (Medicare won't pay for this) or are forced to retire if you become disabled, your additional capital can step in to pay your bills. Over 25+ year periods, the difference in terminal wealth from taking additional risk is massive. Importantly, over time the standard deviation of your terminal wealth compared to your return decreases. On the other hand, the odds of you or someone in your immediate family suffering a health crisis slowly accumulate over time.

5. By my ballpark estimation, there might be 10,000 people in the US using leveraged ETFs as part of a long-term strategy to build capital. There might only be 2,500 people using risk parity to trade futures in the entire world (and 1/2 of them likely work or previously worked at a single firm, Ray Dalio's Bridgewater Associates). On the other hand, there are literally millions of people who aren't taking enough risk in their retirement portfolios to achieve their goals. The ~10,000 people using leveraged ETFs long-term may fail in their objective if US equities fail to appreciate over the long run. I'm comfortable with this risk, as cash rates are low and valuations are fair (currently a ~9.5 percent projected US equity return, ~8 percent in excess of cash). However, the millions of people with oversized bond allocations in their portfolio are certain to fail in their objectives, regardless of which direction the markets go. Although I want everyone to succeed and achieve their goals, most people are simply underfunded and short on time.