As the pandemic continues to alter everyone’s ‘new normal,’ women have been disproportionately affected. According to the U.S. Bureau of Labor Statistics, women are losing more jobs as the result of business closures and layoffs. For women who have held onto their job security, many still face the difficult decision of choosing between career and family.

“The biggest problem is the lack of consensus about schools and childcare solutions, which creates debilitating uncertainty,” said Nancy Folbre, Professor Emerita of Economics at the University of Massachusetts Amherst whose research emphasizes the “hidden” economy of unpaid care work.

Unfortunately, the burden more frequently falls on women to give up their jobs because they earn an average of 18% less than men in the U.S. While some households have chosen to split the housework and childcare duties equally, women spend an average of 15 more hours weekly on domestic labor than men. It begs the question: Is the pandemic simply magnifying unresolved issues, ones that our society has been trying to solve for decades?

Maintaining Momentum

Despite the odds, women have become a powerful force in wealth generation.

In just 60 years, women have amassed great financial power, with females now controlling 32% of the world’s wealth. In fact, women are adding $5 trillion to wealth globally every year and are expected to accumulate wealth at a compounded annual rate ranging from 3.7% to 7.2% in the next four years, depending upon the effects of COVID-19. Nonetheless, women’s wealth trajectory is expected to outpace that of global wealth growth.

A study by The Economist Intelligence Unit found that high-net-worth (HNW) women are entering the top levels of asset ownership faster than Baby Boomer women, with 32% of Millennials having $5 million or more in assets, versus just 22% of Baby Boomer women. And while there are still more HNW men than women, among the wealthiest bracket (those with $5 million or more in assets), the proportion is closer, with 27% men vs. 22% women. Millennial women are not simply inheriting their wealth but also taking control and earning it.

Financial advisors and asset managers, take note. The time has come to place a larger focus on such a powerful – and growing – group of decision makers. The unrelentless nature of COVID-19 has handcuffed women’s efficiency. According to a McKinsey report, women’s jobs are 1.8 times more vulnerable to the crisis than men’s jobs. GDP growth could be at least $1 trillion lower by 2030 given this disparity. On the other hand, working towards advancing gender equality could add $13 trillion to global GDP in the next 10 years.

Advancing Gender Equality Through ESG Investing

ESG investing provides a way to invest in women’s issues, but companies need to do more.

This year has highlighted the increasing importance of how companies approach environmental, social, and governance (ESG) issues. Emphasized by both the COVID-19 pandemic and the resurgence of the Black Lives Matter movement, the ‘S’ in ESG has become paramount for investors and stakeholders. There is a clear link that exists between gender-diverse companies and business performance. Diverse workforces attract more talent, lead to more innovation, create better connections with customers and investors, make better decisions, and perform better financially. On average, global companies with female leadership have experienced financial performance more than double that of the MSCI World Index.

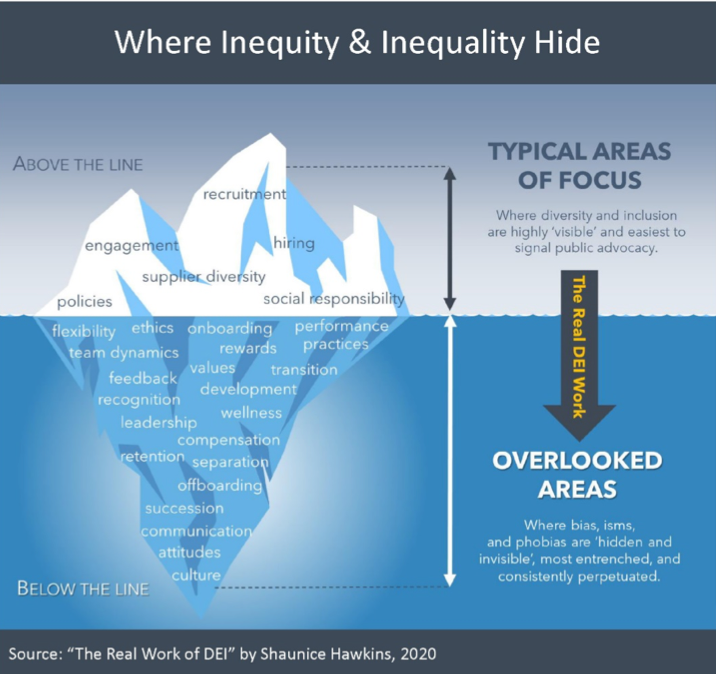

The events of 2020 have increased demand for company transparency and action on diversity and inclusion issues; but reporting on gender-based sustainability topics needs improvement. Too often, the diversity and inclusion section of company sustainability reports focuses only on surface-level statistics, such as the number of women employed in the workforce, rather than on policies that create a company culture that supports women.

Transparent ESG policies make it easier to identify companies that align with investors’ values. For analysts to begin effectively comparing companies in terms of gender equality and diversity and inclusion, company reporting must become more standardized and transparent. There are recognized policies that companies should implement and report on to support their female workforce as well as mitigate the effects of COVID-19. They include formally addressing gender-equality issues; equalizing pay; implementing anti- sexual harassment, violence, and abuse policies; establishing a living wage; providing flexible work options and paid sick and family leave; and ensuring access to affordable, quality childcare (and backup childcare).

Once companies begin reporting on their policies in a standardized way, they must also measure their progress. Effective company policies are utilized. Many companies have paid parental leave policies—but do they track who takes time off? Are companies auditing their employee pay to ensure equity? The bottom line is, does a company’s culture support established policies? Without a supportive company culture, empowering policies is useless. We would like to see companies track the effectiveness of their policies and implement measures (such as anonymous employee surveys) to gauge how they are resonating with employees. Only then can we truly measure the effectiveness of such policies.

The pandemic has laid bare fundamental “Social” issues, and society, employers, and companies are recognizing now more than ever the value of women as leaders, contributors to the economy, holders of wealth, and the glue that binds our households together. Women in the U.S. control over $20 trillion in wealth, they account for upwards of 80% of household purchases, and most of them are looking to invest in the issues they care about, which includes investing in other women. Thus, the continued progress by companies to report on and measure diversity and inclusion issues is of paramount importance. As ESG investors, we will continue pushing for increased disclosure and transparency. Our goal is to choose best-in-class companies that not only implement ESG policies but are intentional in creating measurable outcomes.

This article originally appeared on ETFdb.com.