Investors are increasingly seeking returns beyond U.S. shores as capital begins flowing toward undervalued international markets. Principal Asset Management offers a distinct way to tap into this opportunity through the Principal International Equity ETF (ticker: PIEQ), which distills global markets into 30 high-conviction holdings, aiming to assist with overall diversification and potential long-term return enhancement.

In an interview with Scott Martin from The Wealth Advisor, George Maris, CIO and global head of equities at Principal Asset Management, discussed how PIEQ’s concentrated approach, bottom-up selection process, four-pillar investment philosophy, and global research capabilities combine to create a differentiated international equity solution that seeks to outperform the broader market.

Beyond Indices: A Curated Approach to Global Markets

The traditional approach to international investing often relies on broad indices that may introduce unexpected risks. PIEQ takes a fundamentally different path by selecting about 30 companies from a universe of more than 2,500 securities available outside the U.S.

Maris explains how inefficiencies in global markets—driven by structural quirks and investor behavior—may create ideal conditions for active management to shine over passive index investing.

“The volatility we see in markets and have seen over the last several years indicates just following an index can be a dangerous place to be,” he says. “We’re taking advantage of the volatility markets give us to take positions in companies we think will generate substantial returns and contribute to outperformance for our clients over time.”

Rather than attempting to model the global economy through market-cap-weighted positions, this international equity strategy maintains a laser focus on outperformance through careful selection, a process Maris describes as “giving up the good for the great.”

The high degree of concentration is designed to enable the portfolio to remain nimble while maintaining diversification across global markets. For advisors concerned about concentration risk, Maris offers his view: “It is a diversified global portfolio. We’re very thoughtful with respect to where risk is.”

The careful construction process creates a strategy that aims to deliver strong returns while aiming to minimize excessive volatility, making PIEQ a potentially valuable addition for advisors looking to enhance international exposure without introducing undue risk.

Bottom-Up Selection: Companies over Countries

Unlike many international strategies that emphasize regional or country allocations, PIEQ builds from individual securities upward.

The Principal Asset Management strategy focuses entirely on stock selection rather than country allocation. Every investment decision begins with deep company analysis, constructing the portfolio company by company through an industry lens, rather than region by region.

“We try to look at the world seamlessly. Where are the very best [companies] across industries in the world?” Maris explains. “Some industries are truly global in nature. Take healthcare or technology where they truly encompass everything. And to think about a regional bias in technology or in healthcare is kind of silly.”

This sector-focused approach may help advisors move beyond simplistic home-country emphasis to access genuine opportunity wherever it exists, potentially providing clients with exposure to leading companies regardless of their listing location.

The Four Pillars of Selection

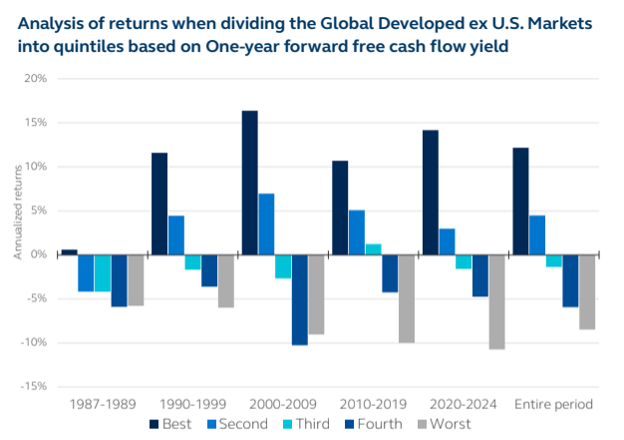

The strategy’s investment philosophy centers on identifying companies “where the free cash flow growth is underestimated by the market”—the north star that guides all security selection, Maris says.

Four essential elements drive the selection process, he explains.

- Free cash flow analysis: The purest measure of a company’s economic output that transcends accounting differences across regions and industries.

- Growth potential: A focus on companies demonstrating growth rather than “declining annuities,” as the Principal Asset Management team defines it.

-

Attractive valuation: Coupled with growth potential, Maris emphasizes that the team is looking for “screaming valuation” as well—not merely reasonable prices—to help elevate holdings.

-

Behavioral factors: Identifying situations where sentiment or structural constraints have created mispricing opportunities, creating market inefficiencies.

Data from January 1, 1987–December 31, 2024. Source: Empirical Research Partners Analysis. Monthly returns compounded and annualized. Does not reflect the performance of an investment product.

Market performance does not reflect the impact of fees, expenses, and transaction costs of investing.

Free cash flow is a measure of profitability accounting for all sources and uses of cash, including capital expenditures and acquisitions.

The traditional growth-versus-value debate misses the point, according to Maris. “We think growth is really incredible. We think value is really incredible. But we don’t think they’re incredible in isolation,” he points out. “We think they’re incredible when you put them together.”

A disciplined application of the selection criteria is designed to allow the strategy to identify opportunities that may be overlooked by single-factor approaches, potentially offering a differentiated return stream compared to those of traditional international allocations.

Global Resources for Global Opportunities

The foundation of PIEQ’s concentrated portfolio is an extensive global research operation built to uncover exceptional companies around the world. The team of sector specialists at Principal Asset Management thoroughly search global markets for opportunities that many U.S.-centric investors might overlook.

“Our primary competitive advantage with resourcing is a great and strong group of fundamental research analysts,” Maris says. “These are industry experts. They’ve got global expertise. They know their sectors and industries as well as anyone.”

Unlike firms that view international markets through a U.S. lens, Principal Asset Management maintains expertise across markets and sectors. Its analysts develop forward-looking perspectives on company operations, allowing them to anticipate business developments before they’re reflected in stock prices—creating potential for outperformance through an educated advantage.

“You can have a heightened degree of understanding so that you can anticipate what business fundamentals are going to do,” Maris explains. “Then you can understand the financial consequences of that and what it is likely to mean from a return perspective to shareholders.”

Flexibility as Macro Conditions Evolve

In uncertain global conditions, PIEQ’s approach focuses on company fundamentals rather than macro forecasts, aiming to provide stability amid changing conditions.

Rather than attempting to predict macroeconomic developments such as GDP growth or interest rate moves—areas where even experts frequently miss the mark—Principal Asset Management focuses on identifying exceptional companies regardless of the broader environment.

“We think about macro more in terms of how we think about the weather,” Maris says. “We’re not trying to forecast it, but before I go outside for a run, I’m going to look at the weather and dress appropriately.”

The strategy remains adaptable to conditions while maintaining its disciplined focus on fundamentals. “We are trying to be both disciplined in our approach and open-minded for opportunities wherever they may appear,” says Maris, describing the approach as “opportunistic,” but always guided by “strong, fundamentally driven, cash flow–oriented investment.”

Navigating an increasingly complex global landscape requires both adaptability and discipline—a balance PIEQ aims to strike through its foundational methodology combined with flexibility to pursue opportunities as they emerge.

A Different Approach to International Exposure

As global capital flows begin to recognize opportunities beyond U.S. borders, the international equity strategy at Principal Asset Management offers a differentiated vehicle for capturing potential international returns.

Through careful security selection, global sector expertise, and a concentrated yet diversified approach, PIEQ aims to provide a potential solution for those seeking to enhance international exposure without assuming unwarranted risk.

“Our goal here is to outperform the global market,” Maris states plainly. “That is our goal, and we seek to do that and have those results manifest over three- and five-year periods.”

PIEQ stands as a manifestation of global capabilities available with Principal Asset Management, bringing a curated portfolio of 30 high-conviction international companies to advisor platforms through an accessible ETF structure. The strategy cuts through market noise to offer what Principal Asset Management believes represents the most compelling opportunities in international markets today. For advisors looking to go beyond passive benchmarks or enhance existing international allocations with a concentrated, research-driven approach, PIEQ might present a thoughtful and powerful solution.

__________________

Additional Resources

_____________________

Disclosures

Carefully consider a fund’s objectives, risks, charges, and expenses. For a prospectus, or summary prospectus if available, containing this and other information, visit www.PrincipalAM.com or call sales support at 800-787-1621. Please read it carefully before investing.

ALPS Distributors, Inc. is the distributor of the Principal ETFs.

ALPS Distributors, Inc. and the Principal Funds are not affiliated.

Unlike typical ETFs, there are no indices that the Principal International Equity ETF attempts to track or replicate. Thus, the ability of the Fund to achieve its objectives will depend on the effectiveness of the portfolio manager.

This Fund is new and has limited operating history.

Asset allocation and diversification do not ensure a profit or protect against a loss.

Investing in ETFs involves risk, including possible loss of principal. ETFs are subject to risk similar to those of stocks, including those regarding shortselling and margin account maintenance. Investor shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Ordinary brokerage commissions apply.

Equity investments involve greater risk, including heightened volatility, than fixed income investments.

International and global investing involves greater risks such as currency fluctuations, political/social instability and differing accounting standards. These risks are magnified in emerging markets. Small- and mid-cap stocks may have additional risks including greater price volatility.

© 2025 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

Principal Asset Management is a trade name of Principal Global Investors, LLC. Principal Global Investors leads global asset management at Principal®.

MM14424 | 4/2025 | 4333520-122025 | PRI001691