Crisis of credibility goes deeper than not trusting the current crop of corporate earnings. Investors reward absolute trust.

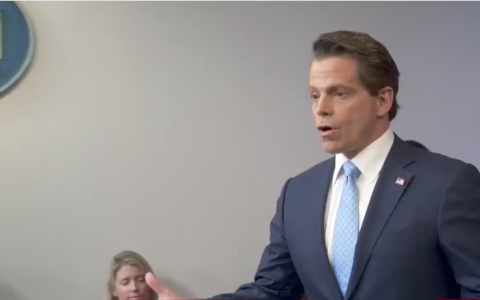

Anthony Scaramucci can be a fun guy. I met him briefly at his hedge fund show in Las Vegas a few years ago. I don’t know if I can trust anything he says.

After all, he’s the guy who splits hairs around whether an outright lie can be an “intentional” provocation or just an attempt to twist the facts for profit.

The provocations apparently serve a strategic purpose in his mind. You lie to make a deeper point or make room in the news cycle for messaging that matters.

In a frenzied information economy, sometimes the shock of challenging the consensus is what it takes to get people’s attention in the first place.

But once you have that attention, maintaining the relationship becomes a delicate pivot back to the truth before your credibility altogether.

If Scaramucci ever goes back to the hedge fund world, I’ll read his client letters with great interest and probably more than a little amusement.

However, I’d look sideways at any pension consultant who takes him seriously enough to allocate money to him. His strategy might be great, it might be terrible.

The problem is that there’s no way to know and no reason to take him at his word. There’s no independent or objective track record beyond his pattern of fudging facts in favor of the outrageous.

Again, the real performance can be as spectacular as advertised. But how do you do your due diligence?

Facts are what bring us together

Industry regulations dictate a certain level of truthfulness among advisors. All the numbers have to match official sources. If they’re manipulated, you need to show your work.

A lot of the work in the back office revolves around reconciling the data trails. That end of the industry is all about building an invulnerable barrier against fudge factors. It’s practically impossible for the numbers there not to line up in a way we can trust.

Stocks move in and out of the right accounts. Money transfers from institution to institution. Custody at every step is transparent and guaranteed.

Things are different on the front end where opinion and personal perspective have more room to color the data. In communications with clients, we all make suggestions as well as statements.

Sometimes we craft the messaging in order to make an argument that aims to persuade clients to take one course of action or another. Naturally we want to look good. And we want to be engaging. We want them to read it.

In a world where every communication competes with endless other attention sinks, the temptation to push them to read it can get intense. There are ways to bend message compliance rules without quite crossing the line.

“Intentional lies” emerge. It’s not a matter of fudging the numbers or anything material, but in order to make the message more compelling an advisor stretches credibility. It happens all the time.

But credibility isn’t elastic. It’s a non-renewable resource. When it stretches, every statement you make beyond that point will be a little more nebulous. There’s just less of a reason to take everything you say at face value.

From Madoff to Musk

The challenge, of course, is that the industry and the markets themselves only have a limited reservoir of trust to stretch.

One Bernie Madoff actively faking his results makes it harder for everyone for decades to come. Clients and prospects alike are less willing to accept any claims at all. They focus on the cracks in the story instead of the facts.

Because risk involves maintaining faith in an ultimately positive outcome even when conditions get bumpy in the here and now, investors focused on the cracks in the story are less likely to hold on through the rough patches.

After all, the evidence of their eyes tells them the market can be a scary place. Getting them past that fear requires an argument they can trust. Otherwise, there’s no reason to stick around for a happy ending that’s as realistic as any other fairy tale.

Every statement that weakens their trust weakens their faith in the market and ultimately in all advisors.

I think we’re all reaping the rewards of an era of publicly scoffing at the facts now. This goes back a long time. It isn’t new.

People rolled their eyes at faked and fudged economic data decades ago. After meeting a few government number crunchers, I have to say I doubt they’re part of any conspiracy of lies. They give us the best data they can.

More to the point, wherever the data come from, there’s a track record of how they correlate with market activity. The release comes out and asset prices move in a pattern we can all recognize and anticipate.

We trust the numbers. But when we stop trusting the numbers, there’s nothing but risk and roulette, a random walk to nowhere.

The economy is booming, according to the numbers. We’re a long way from a recession. Corporate earnings are great and the outlook is far from awful.

And yet when the stocks go down anyway, it points to a lack of trust. Everything is negotiable. Everything is suspect.

It feels like there’s no basis and no foundation for sustainable upside. Some market actors like Elon Musk have earned fanatical trust in some groups and the opposite in others.

If you love Musk, he can say anything and you’ll cheer. Tesla is profitable. The company will never need to seek outside financing again.

But if you won’t believe a word he says, it’s all just words. Sure, there’s a private equity offer on the table and the stock will go out at $420, just to pick a number from out of the air.

Maybe the company he runs is great. If you’re in the group that doubts, there’s never going to be a way to be sure. You can never be a true believer again.

For the institutions that Musk theoretically needs to attract, that’s a problem. Their barriers to trust are much higher than simply wooing a Silicon Valley kid with dreams of jet cars. Even under ideal circumstances they need more compelling arguments.

Now, full disclosure because I’ve never lied to you deliberately: one of our portfolios bought Tesla last week and it’s been a great call so far. We trust him just enough.

I have no idea what the future will bring. Musk might finally abuse our trust beyond the limit. The conference calls might get too weird to accept. It’s a transactional relationship, not a true believer bond for life.

It doesn’t even matter whether his untrustworthy statements in the past have been “intentional,” human error or just ambiguous. If we ever catch him in an intentional lie, we’re out.

But take a Jeff Bezos at Amazon or a Jack Dorsey from Twitter and Square. We all know they juggle the accounting quarter to quarter to make Wall Street as happy as they can.

How far do we think they’ll bend the numbers? When would we find out if it happened?

These are the questions retail investors can’t answer in any constructive way. There’s been too much “intentional” lying and too much erosion of trust.

If the industry can’t convince them with statistical reality, we have a real problem. It takes forever to build a pattern of confidence and a momentary lapse to destroy it.

And the tragic thing is that there’s no reason to lie, no matter how dazzling you want your messaging to be. You can be intentional without lying. The long-term numbers remain good. The world has yet to end. I trust those numbers. Do your clients?