(AAMA) A bubble is a speculative mania, where asset prices are much higher than the underlying fundamentals can reasonably justify.

In the early stages of a bubble, few recognize the bubble for what it is. People notice that prices are going up and often think it is justified. Bubbles are usually identified in retrospect, after they have popped and prices have crashed.

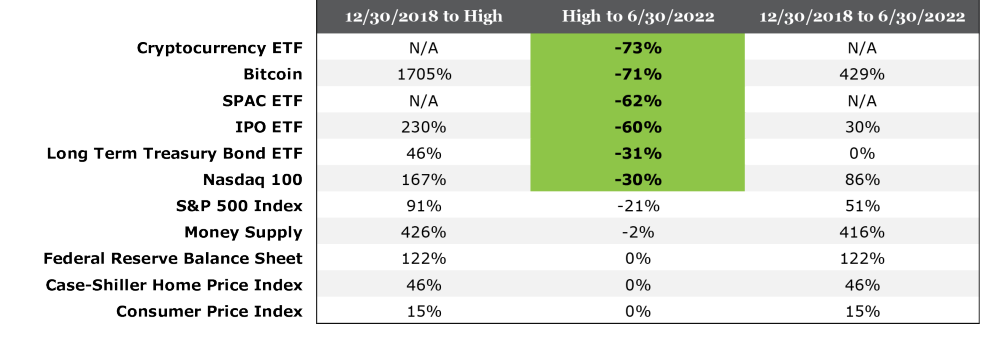

Here is a listing of some asset values, including some of the most bubbly, and a few that cannot yet be identified as bubbles.

We think it is fair to identify the top six listings as having completed a “bubble”—prices higher than reasonable and a subsequent decline of more than 25%.

The S&P 500 has flirted with a 25% decline this year, but hasn’t quite crossed that threshold. Home prices, the poster child of the 2008 financial crises, have not crashed. And the Fed’s balance sheet and inflation have not declined at all.

Housing prices are not as vulnerable today due to tighter lending standards, historically low mortgage rates (yes, even 6% is reasonable to many), and institutional buyers acquiring properties for rental portfolios. The Federal Reserve’s current plans seem to indicate a newfound resolve to fight inflation which (indirectly) should curb the growth of its balance sheet and the money supply.

We do not have any indication for the logical valuation of crypto assets, the SPAC universe is dominated by money-losing operations, and the IPOs of the last few years need time to prove themselves. However, the loss of paper value in these assets along with traditional stocks and bonds is in the trillions of dollars.

The decline will affect many things. Some down payments for a home or a car are gone. Some swimming pools will not be built. And some envisioned luxury goods purchases will not happen. The wealth effect of rising asset prices is currently in reverse and negatively impacts the 65% of our economy represented by consumer spending. However, the burst bubble leaves stock valuations well within the “normal” range.

How Is Advanced Asset Management Advisors Positioned Today?

We remain committed to our fundamental market pricing and sector valuation process.

As indicated in our previous commentaries, our equity portfolios are generally focused in large cap companies, making sure that more defensive sectors are represented—Healthcare remains a standout.

Our fixed income portfolios remain positioned in short-term and high-quality debt instruments to reduce the risk of principal that occurs in a rising rate environment.