If you’re a Gen Xer like me, you likely watched the TV game show “The Price is Right” starring Bob Barker. In the show, a member of the audience was invited to “come on down” and compete for a place on stage. But to get there, they and five other guests had to guess the price of a featured item. As a fan of the show, I was horrible at guessing the amount. Fortunately, in the wealth management business, there’s some clear data on how to price one’s offering and how to charge for your services. In the words of Warren Buffet, “Price is what you pay. Value is what you get.”

Little has changed for industry pricing models.

Over the past 15 years, I’ve followed several industry research and benchmarking studies. Despite a number of so-called existential threats – low-cost advice providers like robo-advisors, volatile markets and increased competition — the “price” of a typical wealth management service offering has remained at 1% for the first million dollars in assets managed. Moreover, this pricing model has stood the test of time. Despite the introduction of project-based, hourly-based, retainer, net worth and income-driven pricing models, the lion’s share of revenue in the RIA industry is based on assets under management (AUM). In the most recent Dimensional Fund Advisors benchmarking study, this number is more than 80%.

Even today, across the AUM fee schedule, pricing continues to be resilient — although we know some discounting occurs. There’s consistency in published-fee schedules across industry reports.

Value model in wealth management is evolving.

Going back to Warren Buffet’s quote, let’s explore the value side of the pricing equation. Some questions you should ask yourself about the tangible aspects of your wealth management offering include:

- What exactly is my offering and what does a client “get” for the 1% fee?

- Can I articulate my value?

- What non-financial areas are included or bundled in with my services?

- Do different client segments get different levels of service or is access available to tailored products at different wealth tiers?

According to research from Fidelity and DFA, many of the firms that are charging 1% only provide three to four services. If you’re a client of those firms, you may, in fact, be paying too much — especially if you’re only getting investment management and simple goal planning. Over time, I believe consumers will find lower cost solutions more attractive for simpler needs. Both Schwab and Vanguard provide straightforward planning and investment management for a fraction of the cost of a traditional fee-based advisor. As other companies are positioned for lower AUM clients as well, this will increasingly be a highly competitive segment.

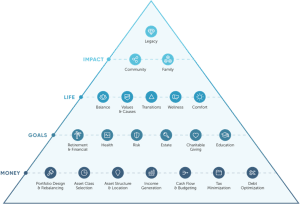

But for clients who value a personalized, proactive advisor whose services span both life and financial areas, you could be in the sweet spot. According to a recent Fidelity report on value versus price, only a small fraction of RIAs offer a comprehensive suite of services, similar to what’s in our Design | Build | Protect® framework.

Quality is just as important as quantity.

But it’s not just the number of services provided, it’s the quality as well. In our internal research with over 5,000 clients, we found the key drivers of both satisfaction and advocacy to be more qualitative aspects of their relationship with you and the value you bring. This includes getting to know the client beyond the money and helping them create a better financial future. Speaking of value, a main factor of both satisfaction and advocacy is a client feeling valued in the relationship.

From a value standpoint, you need to ask yourself these questions:

- Do you know what your clients value?

- Have you asked them lately?

- What are the key drivers of satisfaction for them?

- Are you delivering a referable experience?

With competition and commoditization increasing in the fee-based financial planning industry, now’s the time to determine what your offer includes and the right price. Both factors are important in attracting new clients. And for those clients that have enjoyed some kind of discounted fee over the years, it might be time to have a conversation with them as well. We continue to see firms going through a repricing process with existing clients to ensure everyone is paying the “right price.”

Pricing fairly for the value of your services is essential for the life of your firm.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based on third party data and may become outdated or otherwise superseded without notice. Third-party information is deemed reliable, but its accuracy and completeness cannot be guaranteed. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this information. RN-24-7527

Buckingham Strategic Partners

When advisors work with Buckingham Strategic Partners, they gain the strength of a nationwide community of wealth management professionals. With the support of a diverse team of financial planning leaders, tax professionals, investment researchers and portfolio managers, advisors are able to orchestrate a bespoke plan, tailored to each client’s unique situation. Clients benefit from Buckingham’s team of dedicated professionals who are constantly exploring and assessing the ever-changing landscape of investments, tax code, markets and planning strategies—with a singular focus on maintaining an evidence-driven, fiduciary approach that puts client’s interests first.