Freezing cross-province transfers and replacing $86 billion in paper yuan is only consolidating a process of surveillance where Beijing can monitor all transactions.

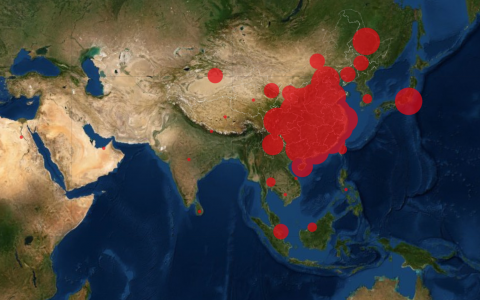

It’s still getting bad in China, where reported coronavirus cases are doubling every 7-10 days. Until that exponential contagion curve flattens out, we just don’t know how far the outbreak spreads or how fast the government will ultimately be able to contain it.

The society that emerges is going to play by different rules. And it starts with Beijing locking down even more of the second-biggest economy in history.

Cash was already going away in China. Now it turns out that the virus shows up on old paper money and can live there for days.

Every time every one of those infected yuan notes moves from hand to hand, it’s another infection vector. If you handle the wrong money, you’re literally carrying the plague.

Naturally that makes people much less eager to accept cash. Luckily there are payment apps to keep everything clean and digital.

But coincidentally enough, the big apps from Alibaba and We Chat already work hand in glove with the central bank. There’s no privacy there. The transactions are open to surveillance.

And with true crypto driven deep underground, cash was the best way left to operate in the country without leaving a transparent digital trail.

Is it any wonder Beijing has started impounding yuan notes in the quarantine zone while stopping transfers between provinces?

Old currency just isn’t getting replaced. Instead it’s being withdrawn from circulation so it can be sterilized. In theory, new money will take its place.

However, barely $570 million in fresh yuan have been issued in Wuhan, the center of the epidemic and economic hub supporting 58 million people. That isn’t even $10 per person to replace infected cash.

Get real. The Chinese government doesn’t really care about making sure everyone has plenty of clean currency to circulate. This is about starving the cash economy without raising too many eyebrows.

It’s practically a golden opportunity to isolate people and enterprises that prefer not to create a digital record. The glory of cash is that it has no memory. Once you hand it over, you vanish. There’s no easy way to reconstruct the chain of custody.

Mobile payment systems make it trivial to trace transactions around the economy. They know who gets paid and what they spend the money on. Gaps in the record are suspicious.

We have something similar here in the U.S., but with cash machines on every corner, it’s still relatively easy to buy necessities without generating a transaction file. The credit bureaus don’t know what we buy with cash. The government will never find out unless we keep receipts for tax purposes.

In China, on the other hand, at least 85% of all consumer activity was conducted over mobile apps before the virus hit. Now that number is probably a lot closer to 90%.

Who wants to go to the market and mingle with people who are potentially infected with a lethal disease? Unless you have a good reason, it’s a lot easier and safer to just call for delivery and let the apps transfer the funds to make it all happen.

Online payments are up close to 50% over last year. That’s not just the quarantine zone. It’s across the country of 1.3 billion people.

And it’s increasingly what we would consider nickel-and-dime stuff, microtransactions. Buy an egg, open the app and scan the bar code. The system knows you bought an egg.

The longer this goes on, the more it feeds long-term habits. Look behind the apps, and the actual wealth is stored at the People’s Bank of China.

We’re talking about 1.4 trillion yuan or $200 billion, three times as much money as the government is theoretically printing to replace infected currency.

The app networks weren’t happy to move the deposits to PBOC but it was literally a deal they couldn’t refuse. They get a little interest now, which previously Beijing wasn’t even going to give them.

From here, it’s only a relatively small step from PBOC knowing exactly how much cash each app is circulating to knowing which bar codes are getting tapped by which accounts.

Think of what the credit card companies know about your purchasing habits. That feeds into their algorithmic models of what you’re like as a person, how big a credit risk you are.

Hand those models to the government and you’ve got the Chinese consumer economy once you impound the cash. And now the cash is going away. Maybe it comes back. Maybe it won’t matter.