(Clark Capital) High net worth investors often have unique tax considerations and expect holistic wealth management from their advisors. According to a survey by the U.S. Department of Labor Statistics, personal taxes are the largest expenditure for high income households.

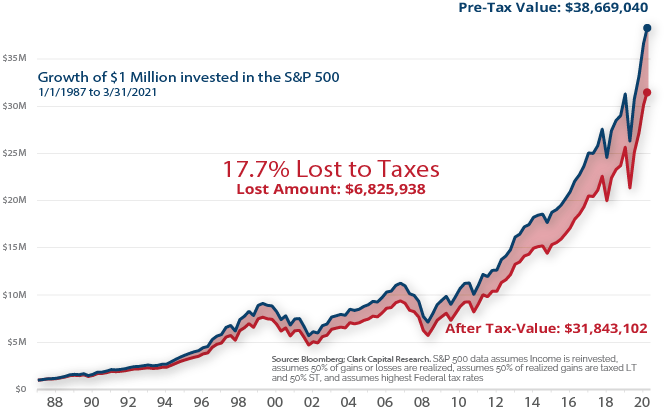

Lack of tax management can impact investors’ long-term results and limit their spending power in retirement. The below chart shows that during a period of over 30 years, a non-managed account lost over $6.8 million due to taxes.

Past performance is not indicative of future results

One way that advisors can deliver better client outcomes is by identifying and implementing the right tax management strategies. Below are five strategies to help you maximize tax alpha for your clients:

1. Tax Transition Strategies

High net worth investors often own securities with low-cost basis. Utilizing a personalized tax transition strategy can help move clients out of low basis holdings over time, without having to take a big tax hit upfront. By spreading out tax consequences over time, your clients’ assets can be thoughtfully reinvested into the right long-term strategy.

2. Capital Gains Management

Clients may be surprised to learn that capital gains can occur even during down years. One way to minimize the impact of capital gains is to use a separately managed account structure in place of mutual funds. Separately managed accounts are only taxed on realized gains in the individual investor’s portfolios, and capital gains may be partially offset through tax-loss harvesting.

3. Asset Location

Consider the tax status of every client account registration (qualified and non-qualified) to identify which strategy is appropriate for the corresponding registration. Planning for optimal asset location across household accounts may help generate higher after-tax returns for clients.

4. Municipal Bond Strategies

For residents of higher tax states such as California, New York and New Jersey, tax-exempt municipal bonds may be an efficient way for investors to shield their taxable income.

5. Tax-Loss Harvesting

Mutual funds and ETFs only harvest losses when the entire account is down. Within a separately managed account structure, portfolio managers can opportunistically harvest investment losses throughout the year to offset gains and reduce ordinary income.

By creating a personalized tax management plan for your clients, you may be able to help them raise cash flow, reduce risk, and increase the long-term value of their portfolios, so they can stay focused on their financial goals and objectives.