(Morningstar) In a research report, Sustainalytics, a Morningstar company, combined Sustainalytics ESG Risk Ratings with Morningstar's Economic Moat Rating to examine the relationship between ESG risk and moat ratings. Using backtesting, the report found that the wider the moat and the lower the ESG risk, the higher the average return of the portfolio and the lower its volatility. Also, combining economic moat and ESG Risk delivered better results than did each strategy individually.

Combining Moats and ESG Risk

ESG risks and economic moats seem to go hand in hand, based on both economic intuition and empirical evidence. However, does it also pay off to combine them in an investment strategy? That is, can we expect a strategy that seeks to select companies performing well in the Morningstar Economic Moat Rating and in the Sustainalytics' ESG Risk Ratings might outperform?

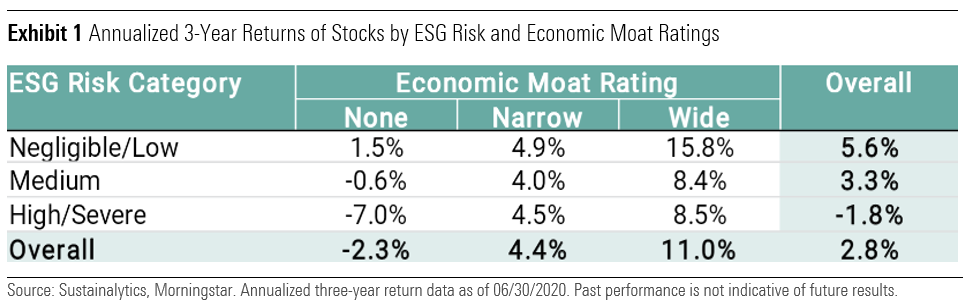

Researchers at Sustainalytics, a subsidiary of Morningstar, Inc., approached this question by sorting company stocks by ESG risk and economic moat ratings. They tested these combinations over a three-year investment period ended 06/30/2020, looking only at those companies that remained in the same categories for both ESG Risk and economic moat since the launch of the Sustainalytics’ ESG Risk Ratings product in November 2018. This provided a sample size of 799 companies.

Over the three-year period, Negligible/Low ESG Risk and wide-moat companies returned a cumulative 55% to shareholders, while no-moat and High/Severe ESG Risk companies led to losses of 20%. While three years is too short a period to draw definitive conclusions, the general pattern appears to be: the wider the moat and the lower the ESG risk, the higher the return.

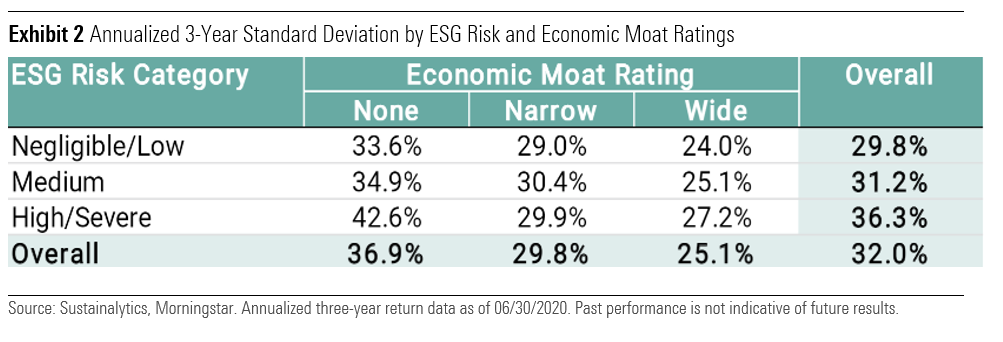

The outperformance of a lower ESG risk and wide-moat strategy may have root causes that are more general and are at work during different market regimes. This is supported by the clear pattern that emerged when we looked at investment risks over the same three-year period as represented by the volatility of monthly returns. Exhibit 2 shows that both ESG risk and economic moat are clearly correlated with volatility following the intuitively expected pattern.

ESG Momentum

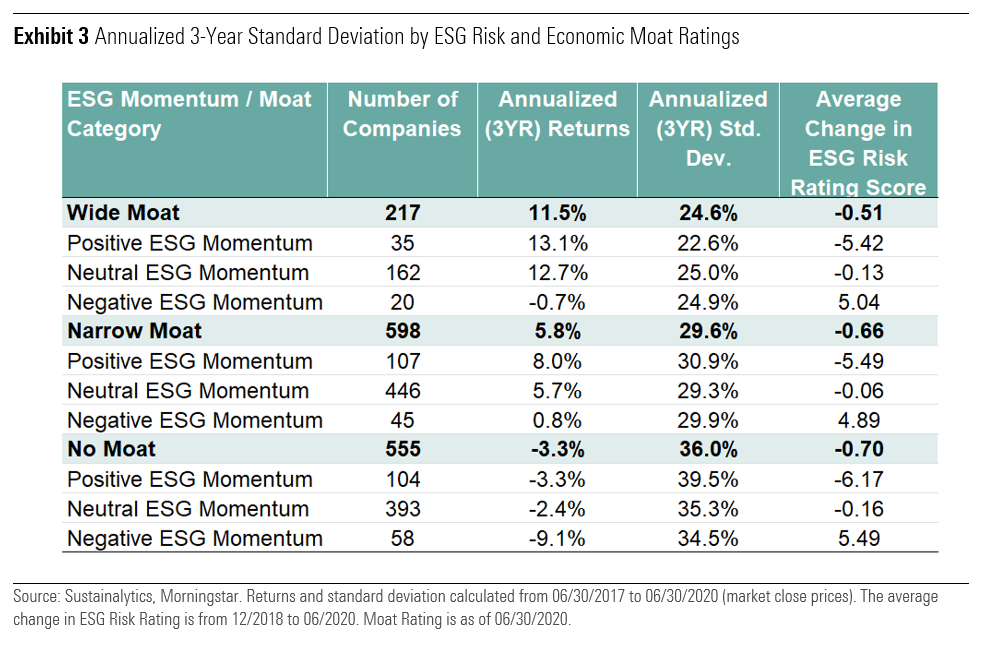

Prior research, however, suggests that identifying companies with improving ESG ratings may also deliver competitive return and risk characteristics. Sustainalytics also analyzed the relationship between ESG Momentum and Economic Moat Ratings with regards to average returns and volatility for 1,340 companies out of the total sample of 1,500 companies.

ESG momentum was defined as:

Positive--A decrease in ESG Risk score of 3.0 points or more;

Negative--An increase in ESG Risk score of 3.0 points or more;

Neutral--A change in ESG Risk score between -3.0 and +3.0.

Wide-moat companies with positive ESG momentum returned 13.1% per year, where companies with a wide moat and a negative ESG momentum saw a decrease of negative 0.7% (see Exhibit 3).

All in all, the results suggested that both metrics, ESG Risk and economic moat, work on a stand-alone basis as stock-selection criteria but even more successfully when combined.