(Morningstar) After 20%+ falls for some U.S. technology stocks and 50%+ falls for innovation stocks, we explore the question: Are technology stocks becoming a buying opportunity?

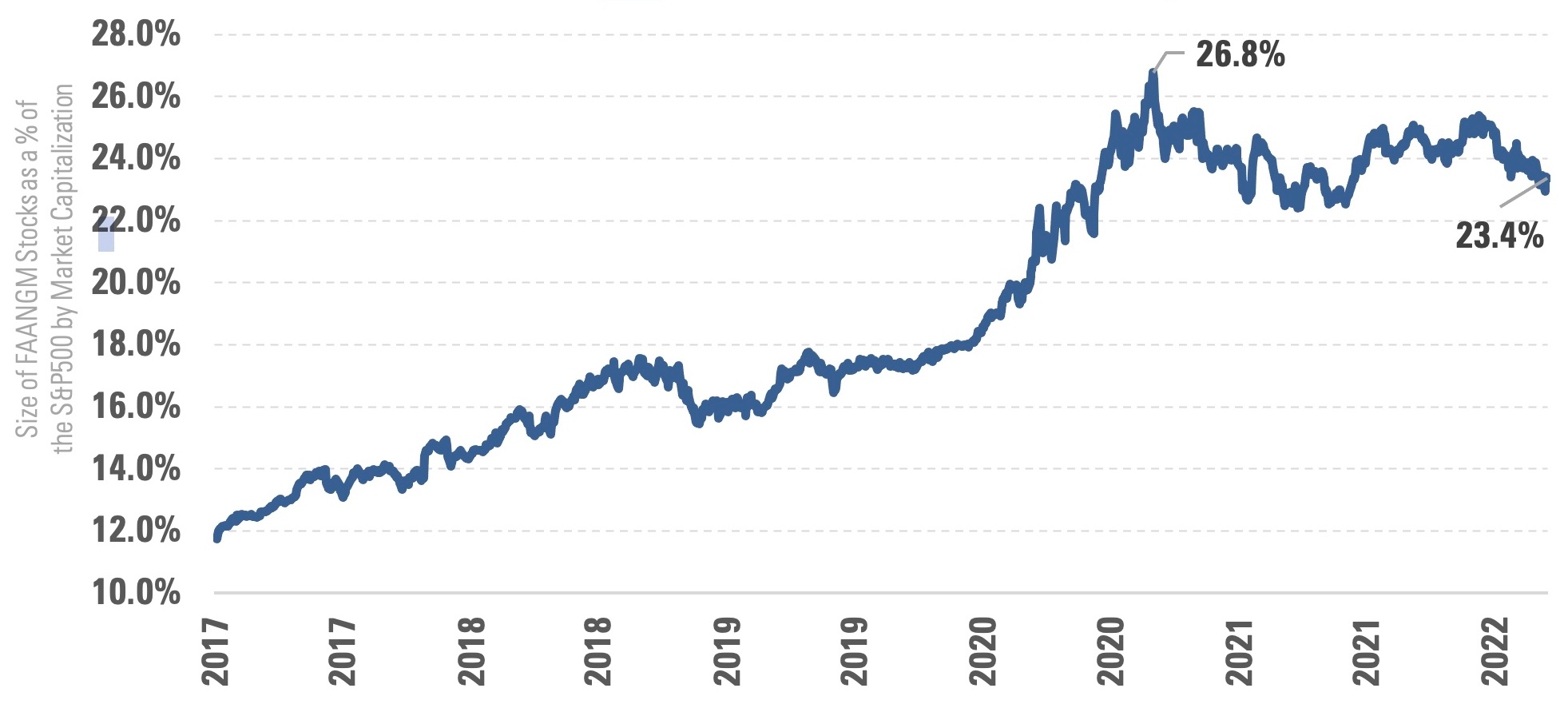

Many investors that follow Morningstar Investment Management’s research closely will know we haven’t been fond of U.S. technology stocks for a while now. We have produced several pieces on this, including one titled “FAANGM Stocks are now 24% of the Market. So, What Next?” in October 2021 that warned of concentration risks and encouraged investors to take a differentiated view of Facebook (Meta), Amazon, Apple, Netflix, Google (Alphabet) and Microsoft.

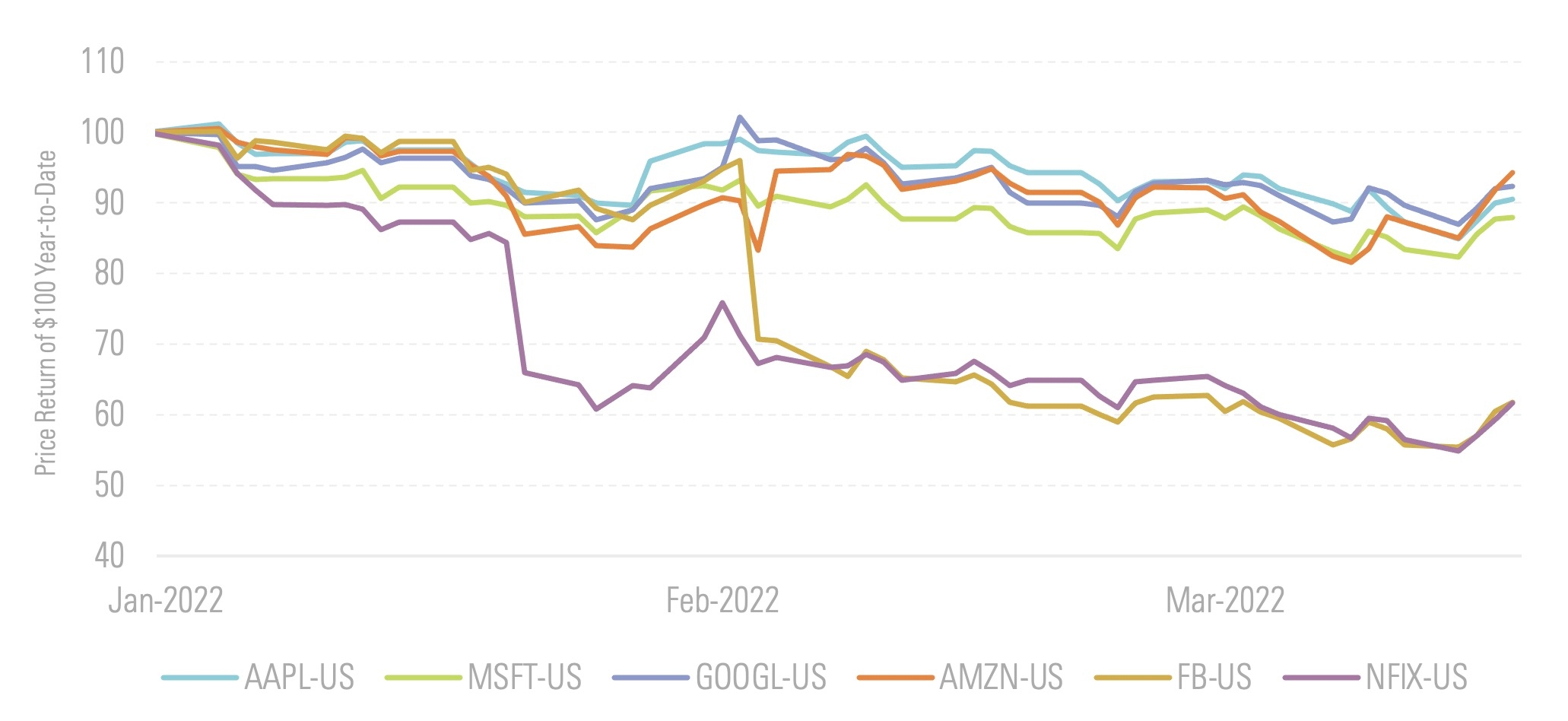

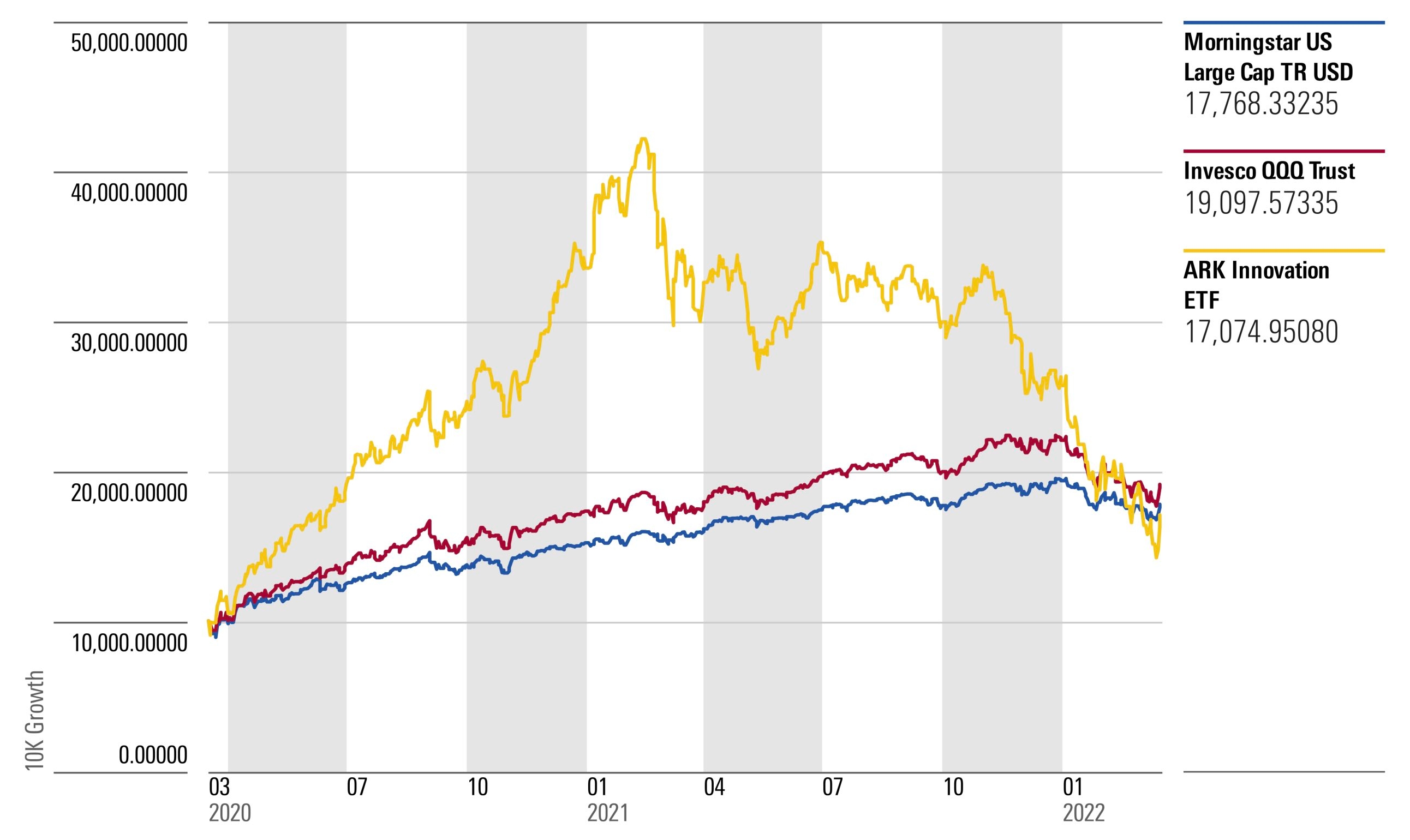

But things have changed. Markets have experienced a significant shift in leadership in recent months, with high growth and meme stocks underperforming significantly. FAANGM stocks—Facebook (Meta), Amazon, Apple, Netflix, Alphabet and Microsoft—have faced significant divergence so far in 2022. Nowhere is the innovation downturn more noticeable than in the significant decline in the performance of the ARK Innovation ETF, managed by Cathie Wood, which more than halved over 12 months.

Exhibit 1: FAANGM Stocks Have Experienced Divergence in this Downturn

Source: Morningstar Direct, to March 17th, 2022. For illustrative purposes only.

The cause of the underperformance is multifaceted, but one influence stands out above the rest: the significant increase in inflation and the subsequent expected increase in interest rates. Disappointing growth guidance has also contributed at an individual stock level, but the repricing of valuations is the primary driver that has caught many investors off guard.

Exhibit 2: To the Moon and Back for Innovation Stocks

Source: Morningstar Direct, from March 18th, 2020 to March 17th, 2022. For illustrative purposes only.

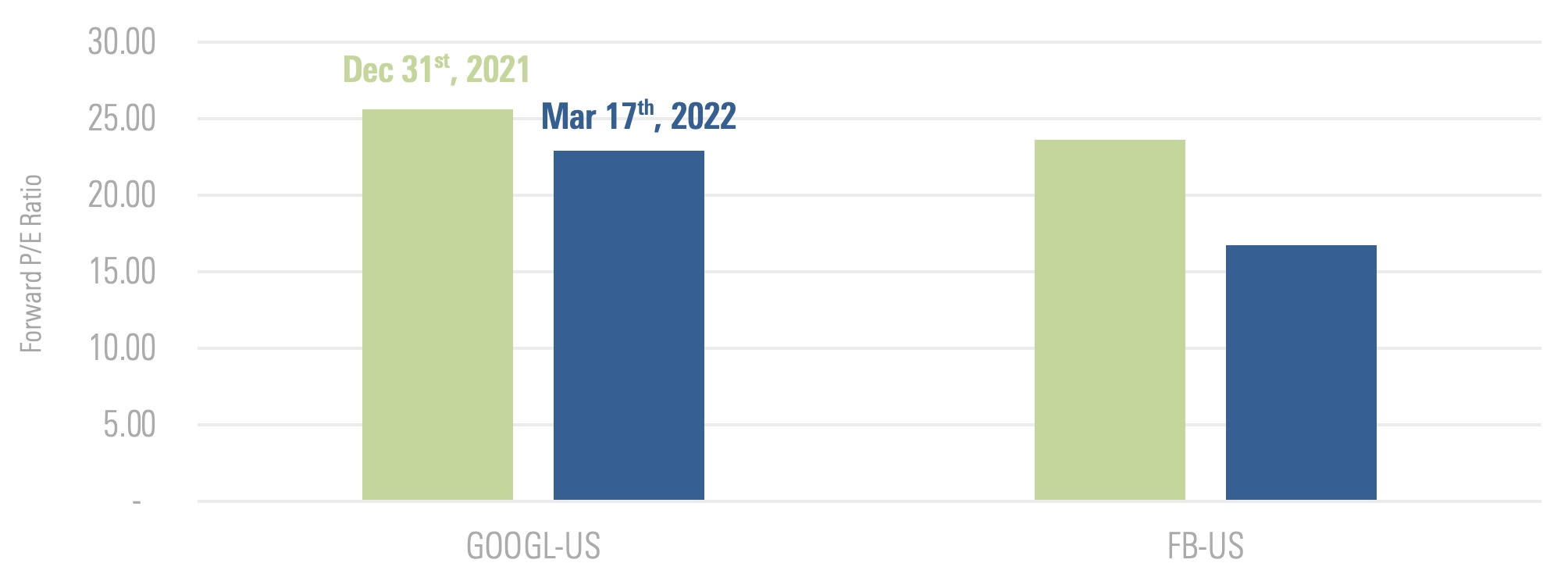

Looking at the fundamentals, we find that in most cases the majority of the intrinsic value in technology companies is still tied to their very long-run growth expectations. The implied market growth expectations were excessive and beyond reasonable base rates, in our view, but they have started to become more reasonable. Forward price-to-earnings multiples (based on consensus estimates) have also declined, although some have fallen more than others.

Exhibit 3: Forward Price-to-Earnings Ratio: Lower is Usually Better

Source: PitchBook™ calculation as of March 17th, 2022. For illustrative purposes only.

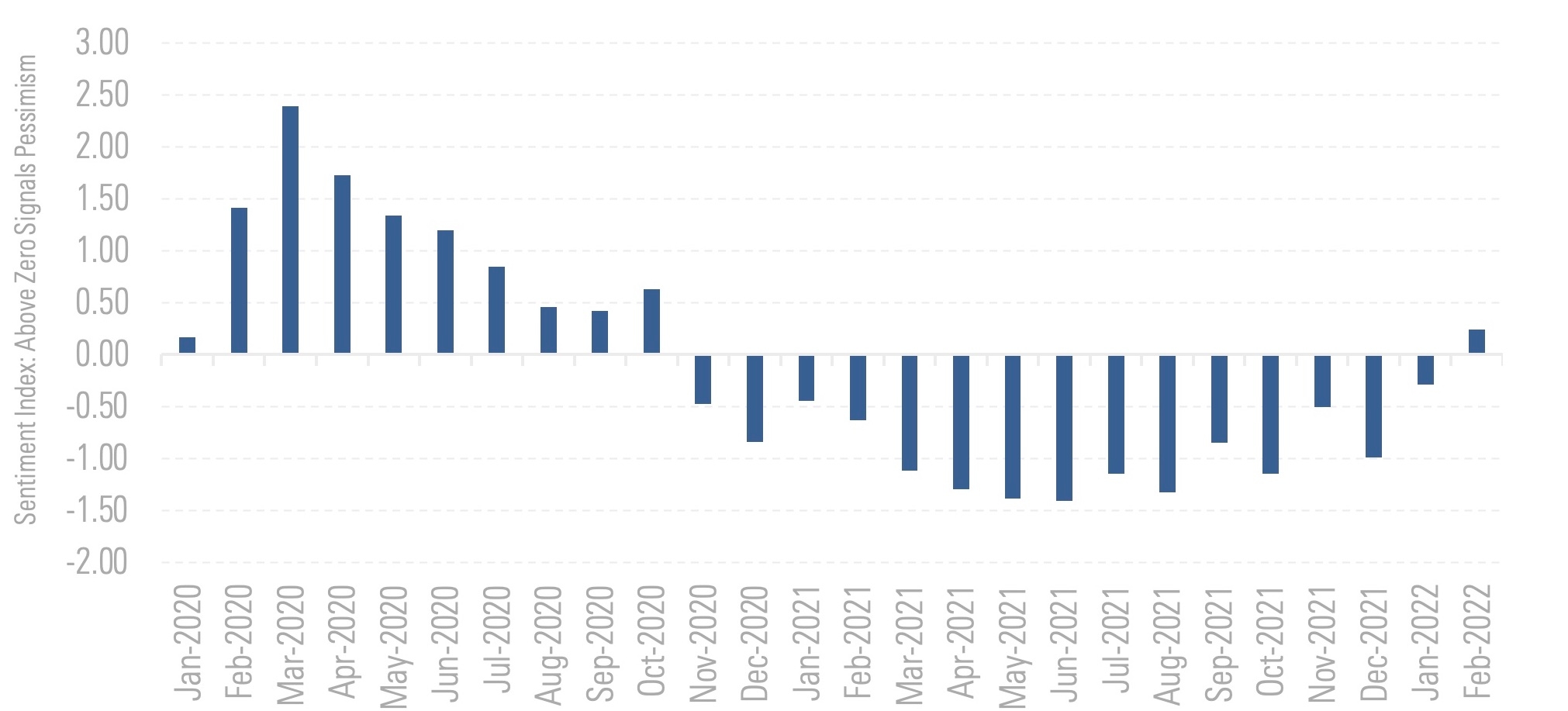

That said, we’d warn against thinking the entire technology sector has become a great buying opportunity. Our own proprietary sentiment index saw a significant pull back in bullishness and today sits at a medium level. This suggests that the froth has come out of the market, but we’re not yet seeing signs of pessimism. Specifically, the Morningstar Investment Management Sentiment Measure has moved from a Low-Medium level to a score associated with Medium as investor sentiment has become less bullish over the course of 2022.

Exhibit 4: Our Sentiment Index is Trending Back to Normal Levels

Source: Morningstar Investment Management calculation as of March 1st, 2022. For illustrative purposes only. The Morningstar Sentiment Index tracks investor risk aversion. A high score indicates a high level of pessimism as reflected in expectations, positioning, and market pricing. The opposite set of conditions would support a low score.

Taken together, it prompts the question: what should investors do now? While the forward-looking prospects have certainly improved for growth stocks, we find better reward for risk elsewhere. The recent geopolitical uncertainty surrounding the Ukraine-Russia conflict has afforded us the opportunity to take profit in our energy positions and allocate proceeds to areas that saw valuations improve, such as European banks, Germany and China. So, while FAANGM stocks feature in our portfolios, they are not an overweight position in aggregate.

Exhibit 5: Care Still Needs to be Taken with FAANGM Concentration as It Is Still High