Following an internal deep-dive presentation on global energy stocks, we spoke to James Foot and Bryce Anderson at Morningstar to capture the key takeaways via a Q&A format. Here is what they had to say.

Why is global energy important to a multi-asset investor? From a “top of the ocean” point of view, why might an investor want to buy energy companies?

A lot of people are cautious about the outlook for the energy sector, but this is potentially to their detriment. Let's start with the bad news. The sector obviously faces some long-term structural questions as the world moves to de-carbonize, plus the shorter-term picture has also been clouded by the pandemic, meaning returns are unlikely to come in a straight line.

Now let's get to the good news. Despite the potential for further challenges (e.g. until global vaccination rates reach scale) the global energy sector has survived its darkest days, with a negative oil price at one point. Additionally, the longer-term transition towards cleaner energy remains broadly on track despite some concerns about the profitability of clean energy.

As long-term, valuation-driven investors, our goal is to look through shorter-term noise. Therefore, as part of our recent review we wanted to re-assess the ongoing appeal of global energy under a range of scenarios while also accounting for the underlying renewable and production trends.

What do you say to people who think the sector is in structural decline? Does the move to renewables and clean energy increase the risks for these stocks?

The response to the structural challenges facing the industry have differed across the world. The major European companies see the writing on the wall and are making a meaningful pivot towards renewables. For example, BP is aiming to reduce oil and gas production by 40% by 2030. Meanwhile, the larger U.S. companies are currently taking a slightly different approach through investment into mitigating technologies such as carbon capture and storage, rather than through material investment into solar or wind. This development is particularly interesting, especially when we consider climate change risk.

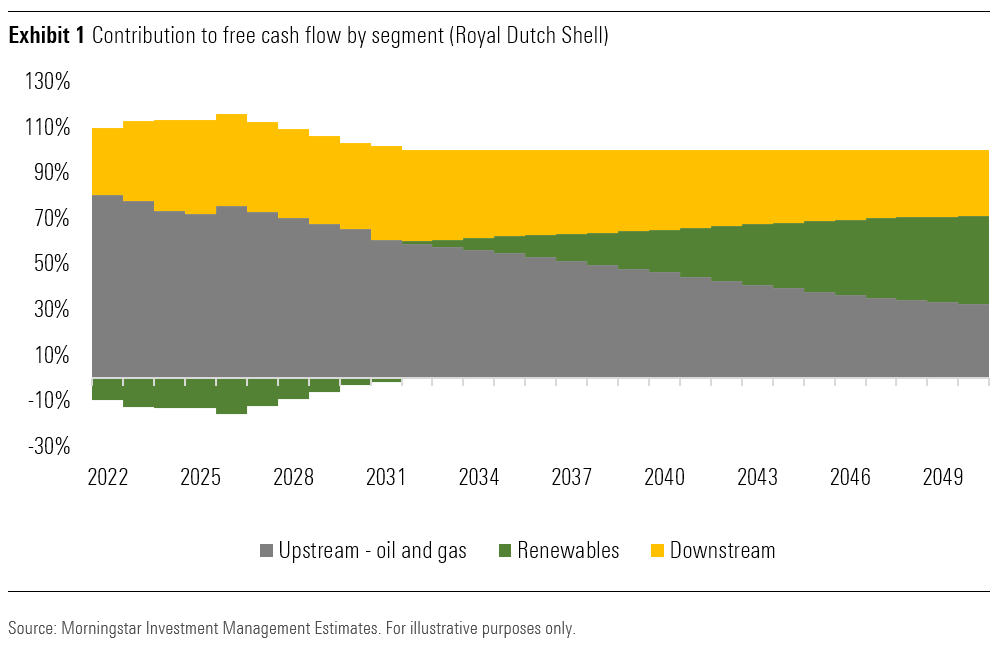

The response of industry and the uncertainty around the renewables investment has in part created the opportunity. The expected cash flow profile of Shell is a good example of how the European integrated energy companies are expected to change over the long term. Renewables are not expected to turn free cash flow positive for at least a decade within the Shell business, but in time, are expected to become meaningful contributors to value.

Our modeling indicates that by 2050, renewables are likely to make up around 38% of the overall cashflows produced by Shell, 42% for Total and slightly more for BP. At the same time, their upstream businesses are expected to shrink to just 36% of total cash flows, on average across the three.

What are the key drivers of energy stocks? Does this differ between the US, Europe, and elsewhere?

As it stands, the drivers of global energy revolve around production and price. In the short term, economic activity and restrictions (such as those imposed by OPEC or sanctions), along with some supply dynamics like shale oil production are key. In the medium-term, capex from the non-shale producers will further drive supply as energy companies react to the environment. While in the long run, demand will be a function of energy intensity (the amount of energy required per unit of GDP) together with global implementation of emission targets.

In terms of differences between U.S. and European companies and how that has influenced their performance, there are a few key drivers:

- Mix of business – Upstream vs downstream. Upstream is the extraction of oil and gas from the source. Money is made by selling product at the prevailing oil/gas price over and above what it costs to get out. Downstream includes refining and then the sale of marketable product like jet fuel and petrol to end consumers. Downstream given the lockdowns and restricted mobility was decimated last year as demand for end-product plummeted. European integrated players generally have more exposure to downstream versus the U.S. players. This has been felt in performance.

- Mix of product – The two main upstream products are Crude Oil and Natural Gas. Whilst natural gas has linkages to oil prices, it also has its own nuances. The U.S. players have more oil exposure and along with their upstream tilt means they have a tighter relationship with the oil price, everything else being equal. This was also seen in their performance during the recovery of the oil price.

- Direction on strategy – The European players have made some clear actions and statements around their approach to address the climate change challenge and their role in creating a sustainable future. They have made significant investments in renewables and plan to continue that. The US names by comparison, whilst acknowledging the problem, have invested very little. The market clearly does not like the strategy of the European players venturing into what is not seen as a high returning area (compared to their legacy assets) and with a questionable history in executing their strategy.

How important are the “big 5” (BP, Shell, Total, Exxon, Chevron) in your thinking? Anything specific that worries or excites you in this space?

Collectively the big 5 make up more than 40% of the MSCI World Energy Index. Among the listed players, they hold the better assets and are generally the lowest cost producers. This is key because of where the industry is heading. It also means they will be operationally better placed to survive when there is volatility or lower prices in oil markets.

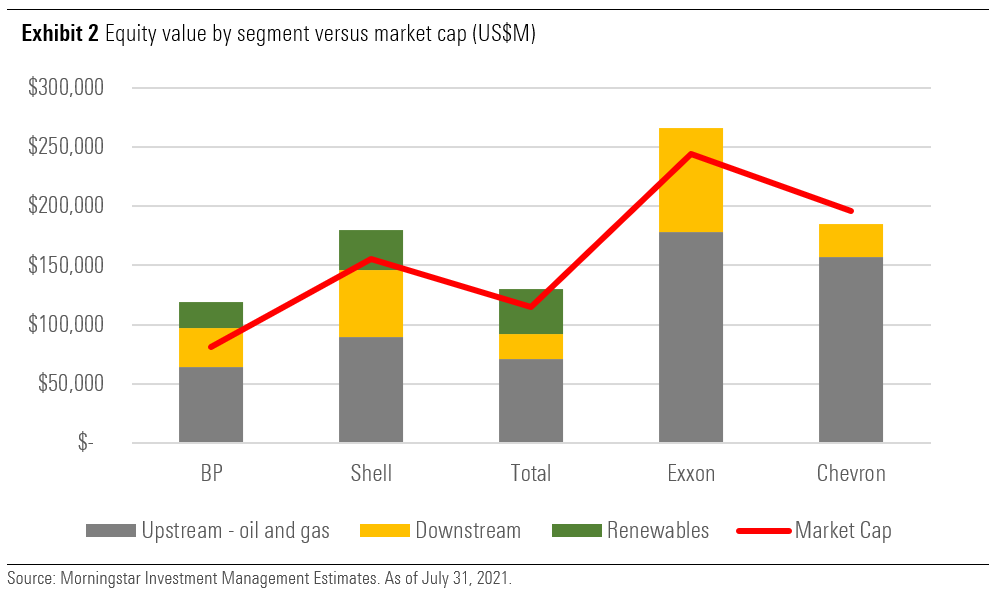

To add an additional perspective to our long-term assumptions for global energy we built a 30-year discounted cash flow model for BP, Shell, Total, Exxon and Chevron. This analysis suggests that the renewables segment is effectively a ‘free’ option attached to BP. Obviously, the modeling over such a long-time horizon contains an element of uncertainty but it enables the long-term transformation to be assessed and valued.

While a central case of US$55 per barrel for West Texas Intermediate (WTI) applies, the framework also allows us to stress test the model to a range of scenarios, including higher and lower production and oil prices as well as different return scenarios for the renewable business. Our findings here show that under the central case all the European majors are priced below fair value (see exhibit 2). Meanwhile, a long-term oil price of $45 per barrel (WTI) would mean companies like BP are around fair value.

Can you please summarize your conviction for everyday investors?

An important aspect of the opportunity is separating the business opportunity from the investment opportunity. Below, we focus on the investment opportunity.

On a conviction scale from low to high, we rank the global energy sector with a "medium" score overall, but a "medium to high" score for relative value. In a world where few assets stand out as being priced to deliver superior returns, there are parts of the global energy complex that remain undervalued. This is particularly the case among some of the large integrated energy companies in Europe.

Of note, the fundamental risk pillar of our analysis ranks as a "medium to low" (that is, it ranks poorly, with higher risks than normal). The energy sector is certainly a challenged one given the outlook for their core business, with a pivot required in the industry, which clearly carries uncertainty around that. But the investment opportunity is much brighter. As is often the case, those risks are well and truly being priced by the market, such that, despite the recent sharp rise in oil prices, they still present a very attractive investment opportunity.

Opinions expressed are as of the current date; such opinions are subject to change without notice. Morningstar Investment Management shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information, data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Please note that references to specific securities or other investment options within this piece should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Performance data shown represents past performance. Past performance does not guarantee future results. All investments involve risk, including the loss of principal. There can be no assurance that any financial strategy will be successful. Morningstar Investment Management does not guarantee that the results of their advice, recommendations or objectives of a strategy will be achieved. This commentary contains certain forward-looking statements. We use words such as “expects”, “anticipates”, “believes”, “estimates”, “forecasts”, and similar expressions to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. Past performance does not guarantee future results. Morningstar® Managed PortfoliosSM are offered by the entities within Morningstar’s Investment Management group, which includes subsidiaries of Morningstar, Inc. that are authorized in the appropriate jurisdiction to provide consulting or advisory services in North America, Europe, Asia, Australia, and Africa. In the United States, Morningstar Managed Portfolios are offered by Morningstar Investment Services LLC or Morningstar Investment Management LLC, both registered investment advisers, as part of various advisory services offered on a discretionary or non-discretionary basis. Portfolio construction and on-going monitoring and maintenance of the portfolios within the program is provided on Morningstar Investment Services behalf by Morningstar Investment Management LLC. Morningstar Managed Portfolios offered by Morningstar Investment Services LLC or Morningstar Investment Management LLC are intended for citizens or legal residents of the United States or its territories and can only be offered by a registered investment adviser or investment adviser representative. Investing in international securities involve additional risks. These risks include, but are not limited to, currency risk, political risk, and risk associated with varying accounting standards. Investing in emerging markets may increase these risks. Emerging markets are countries with relatively young stock and bond markets. Typically, emerging-markets investments have the potential for losses and gains larger than those of developed-market investments. A debt security refers to money borrowed that must be repaid that has a fixed amount, a maturity date(s), and usually a specific rate of interest. Some debt securities are discounted in the original purchase price. Examples of debt securities are treasury bills, bonds and commercial paper. The borrower pays interest for the use of the money and pays the principal amount on a specified date. The indexes noted are unmanaged and cannot be directly invested in. Individual index performance is provided as a reference only. Since indexes and/or composition levels may change over time, actual return and risk characteristics may be higher or lower than those presented. Although index performance data is gathered from reliable sources, Morningstar Investment Management cannot guarantee its accuracy, completeness or reliability. Index Information Individual index performance is provided as a reference only. Each index is unmanaged and is not available for direct investment. Since indexes and/or composition levels may change over time, actual return and risk characteristics may be higher or lower than those presented. Although index performance data is gathered from reliable sources, we cannot guarantee its accuracy, completeness or reliability. Index data sources are as follows. S&P 500 Index—An index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P 500 is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe. The S&P 500 is a market value weighted index. MSCI EAFE Index (Europe, Australasia, Far East)—A free float-adjusted market capitalization index designed to measure the equity market performance of developed markets, excluding the U.S. & Canada. Bloomberg Barclays U.S. Aggregate Index—A market value weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of at least one year. MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets