(Schafer Cullen) On March 7, the NASDAQ dropped into bear market territory, down -20% from its high and is now off -32% for the year. On June 13, the S&P 500 broke through the -20% level, is now off -23.1% for the year.

The question now is: will a recession follow, and what is the best way to deal with bear markets and recessions?

The only good news in all of this is that historically difficult markets like the one we’re in tend to be very good for the relative performance of value investing.

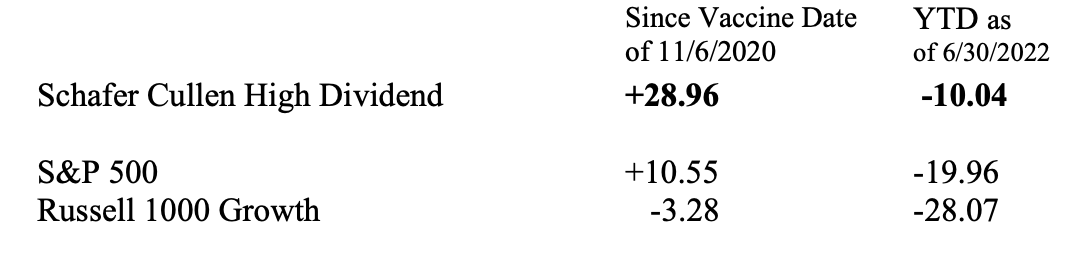

Tracking performance from the day the COVID vaccine became available on 11/6/2020 to the present and year to date, we see that the Schafer Cullen High Dividend Value strategy continues to dramatically outperform the S&P 500 and the Russell 1000 Growth Index.

Ben Graham’s Advice

Ben Graham’s message in 1974 was: “if you invest with a value discipline (P/B, P/E, dividend yield) and have a long-term approach, you can forget everything else”.

Our initial reaction back then was, how can you possibly forget all the nasty bear markets and recessions that periodically pop up over the years? Time and experience have shown us that Graham was right.

Recession and Bear Market History

Recessions and bear markets tend to overlap each other, so therefore, we consider them together. This is important because many investment mistakes are made trying to time the market around bear markets and recessions.

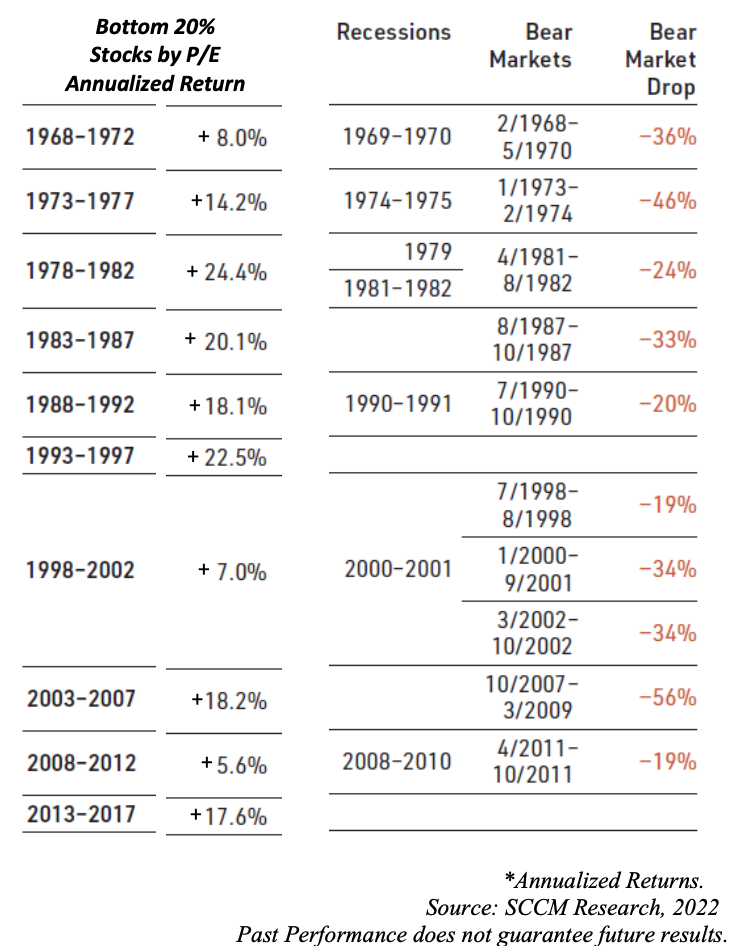

The table below shows all consecutive five-year periods dating back to 1968. Alongside, we lay out all the recessions and bear markets for the S&P 500 over those same five-year periods. As you can see, the results are positive for value stocks (bottom 20% by P/E) in every case despite some very tough markets.

The Bounce

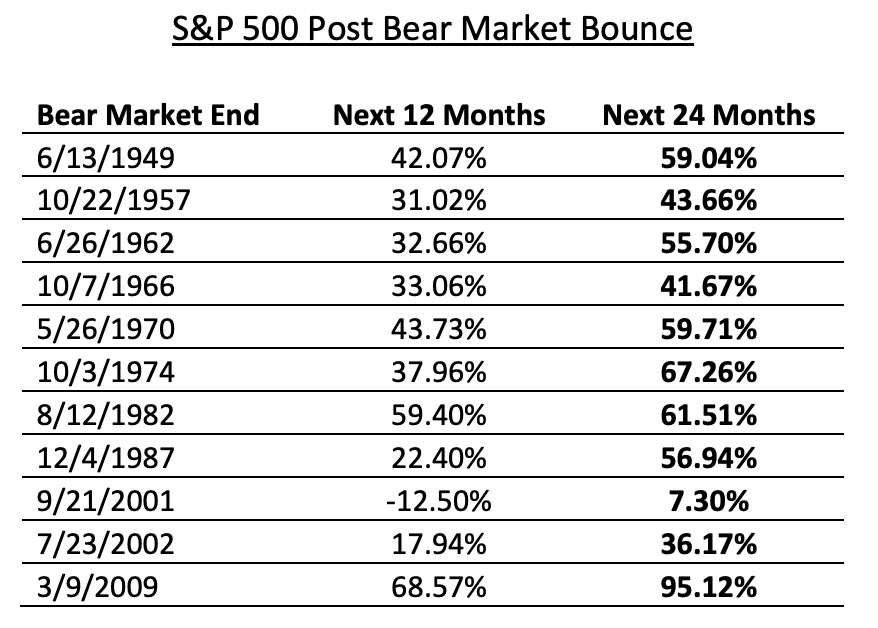

One reason behind these results and what helps explain why the five-year time period smooths performance to such a degree is the phenomenal bounce investors experienced at the beginning of a bear market recovery, which you can see below.

The Recovery

We were curious, looking at the powerful bounce of the S&P 500, how value did in comparison.

What studies show is that value did better in most of these periods, demonstrating that not only does value do well in tough markets, but also continued to do well in the recovery that followed.

To support that conclusion, we refer to a study by the Fama/French research think tank stating: “Brace yourself for a long value cycle”. The report shows that after bear markets, value outperforms for many years.

Conclusion

As we have regularly pointed out, the key to success in the stock market is to invest with a discipline and invest for the long term, and not to lose focus and be distracted by bear markets and recessions.

Jim Cullen

Chairman & CEO